Ever feel like everyone's fundraising but no one's building?

You scroll LinkedIn. Another founder raised $3M. Another pre-seed deck with 20 slides and zero customers. It's enough to make you feel like you're behind if you haven't raised or a fool if you're trying to.

But let's pause the noise and get real.

In today's AI-fueled startup landscape, money is moving fast but not always smart. The question isn't should you raise? It's what kind of capital fits the company you're actually building?

There are three paths. Each has its own psychology, its own pace, its own hidden price. To understand what financial readiness looks like at each stage, see our guide on startup stages and financial readiness for growth.

Let's break down the difference between bootstrapping, seed-strapping, and traditional fundraising and how to choose the one that won't kill your business or your soul.

1. The Bootstrapping Mindset: Control with a Cost

Bootstrapping is brutal but beautiful.

You control everything. Vision. Product. Timeline. Nobody's breathing down your neck for a hockey-stick chart.

But here's the tradeoff: speed and resources.

In an AI world where timing matters, waiting too long might mean you're late to the revolution. Bootstrapping in SaaS or ecommerce often means solving real customer pain first because if they don't pay, you don't eat.

Bootstrapping forces clarity. It sharpens your focus like a survival knife. You get lean. You get scrappy. You build products customers want, not just products investors like.

When bootstrapping works best:

- You have domain expertise and access to your target customers.

- You're building a tool with immediate utility, not speculative tech.

- You value control more than speed.

**Danger zone:

**When pride turns to martyrdom. If you delay hiring, tech upgrades, or growth tactics out of scarcity instead of strategy, you're sabotaging your own climb.

**Action Step:

**Ask yourself: If I had $500K tomorrow, would I spend it wisely or waste it trying to figure out what problem I'm solving? If you're still iterating, bootstrapping buys you clarity. If you're scaling, it might strangle you.

2. Seed-Strapping: The Hybrid That's Taking Over

This is the new default path for AI-era founders.

Seed-strapping is when you raise just enough to survive and validate, without going full venture mode. Think $100K to $500K. From angels. Syndicates. Founder friends. No board. No expectations of explosive 10x in 2 years.

It's the test-drive before the full VC marriage.

In the world of AI, where infra is cheap and models are accessible, seed-strapping gives you permission to experiment without pressure to prematurely scale.

Treat early capital like rocket fuel in a garage-built car. Use it to get out of the driveway, not to build a racing team before you've hit 30 MPH.

When seed-strapping works best:

- You need some initial capital to build a working prototype, not just pitch decks.

- You want to prove traction before chasing a larger round.

- You want optionality, raise more later, or stay lean and profitable.

**Danger zone:

**When you burn seed money validating what already doesn't work. If you raise $250K and spend it on marketing before product-market fit, you're not seed-strapping you're seed-burning.

**Action Step:

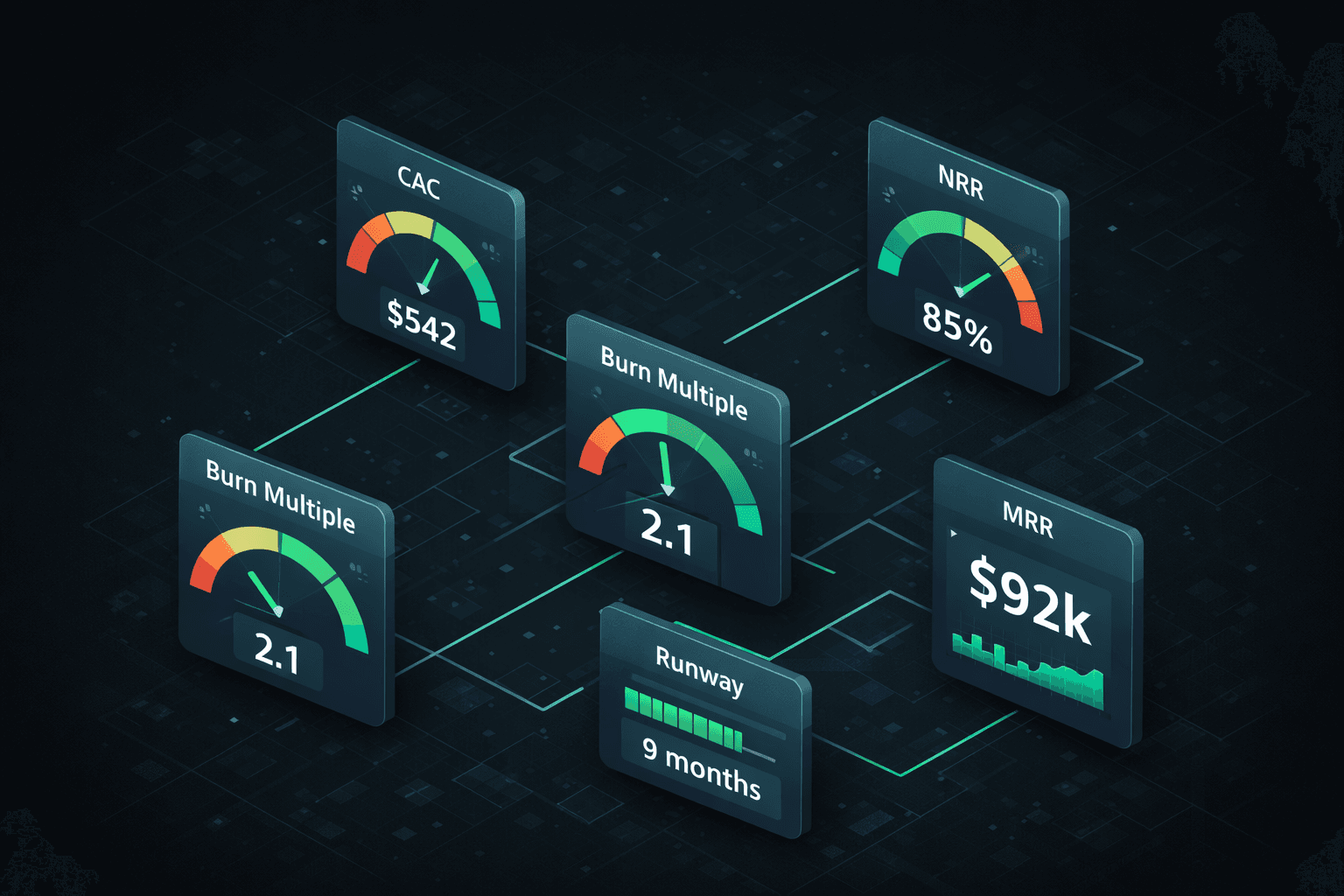

**Make a "survival sprint" plan for 6 months. Write down exactly what traction metrics you'll hit (users, revenue, LTV/CAC) and what decision you'll make at the end: scale, raise, or kill it.

3. Traditional Fundraising: The Fuel for Scale, Not Search

Raising $1M to $5M is not validation, it's commitment.

VCs aren't buying your product. They're buying your potential to dominate. If you don't believe in blitzscaling or becoming a category leader, don't play this game. In the AI world, this path fits founders going after defensible IP, platform dominance, or infrastructure-layer bets. It's less forgiving but if it works, it explodes.

Don't raise venture capital to find a business. Raise it because you already found one and need help blowing the roof off.

When traditional VC makes sense:

- You have a working product with strong early traction.

- The market is exploding and speed is everything.

- You can clearly articulate a venture-scale outcome.

**Danger zone:

**When you let the money steer the mission. You'll build what VCs want, not what your customers need. And you'll get trapped on a treadmill of more, faster, now.

**Action Step:

**Build a "VC pitch rejection map." For every reason a VC might say no (too small market, unclear moat, slow growth), write how you'll prove them wrong in the next 90 days. That clarity might help you pitch or might show you that VC isn't your path yet.

The Truth: Funding Is a Mirror

Money doesn't change your company. It reveals it.

Bootstrapping reveals your resilience.

Seed-strapping reveals your resourcefulness.

VC funding reveals your readiness for scale.

Which path is right for you? That depends on your risk tolerance, business model, and whether you're building a rocket ship or a cash machine.

But in an AI-first world, the real asset isn't capital, it's clarity. Clarity about your market. Clarity about your edge. Clarity about your endgame. If you get that right, the money will follow.

Final Thoughts

Every funding path is a bet.

Bootstrapping is a bet on yourself.

Seed-strapping is a bet on validation.

VC is a bet on velocity.

Choose the bet you can stomach. Then build like hell to win it.

Thinking about raising? See what it will actually cost you. Use our equity dilution calculator to model different round sizes, valuations, and ownership outcomes before you sign anything.

No matter which funding path you choose, knowing your numbers gives you leverage. Futureproof gives founders the clarity to model cash flow, track burn, plan hiring, and run "what if" scenarios in seconds. If you're serious about making confident financial decisions whether you're bootstrapping or pitching VCs, start your free trial of Futureproof today.