The Rule of 40 is one of those metrics that gets thrown around in founder circles like a secret handshake. Everyone mentions it. Few understand when it actually applies to their business. Even fewer know what to do with it.

If you're running a SaaS company, you've probably heard that your growth rate plus profit margin should equal 40% or higher. But here's what most content won't tell you: this metric is essentially meaningless until you hit a certain scale. And treating it like gospel too early can lead you to make terrible decisions.

Let's fix that.

What the Rule of 40 Actually Measures

At its core, the Rule of 40 is a balance test. It asks: are you growing efficiently?

The formula is simple: Revenue Growth Rate (%) + Profit Margin (%) ≥ 40%

A company growing at 60% with a -20% margin hits the rule. So does a company growing at 10% with a 30% margin. Both equal 40%. Both pass the test.

But here's the insight most people miss: these two companies are in completely different stages of their journey, with entirely different strategic priorities. The Rule of 40 doesn't tell you what to optimize for, it just tells you if you're in the acceptable zone of the growth-profitability tradeoff.

When the Rule of 40 Actually Applies

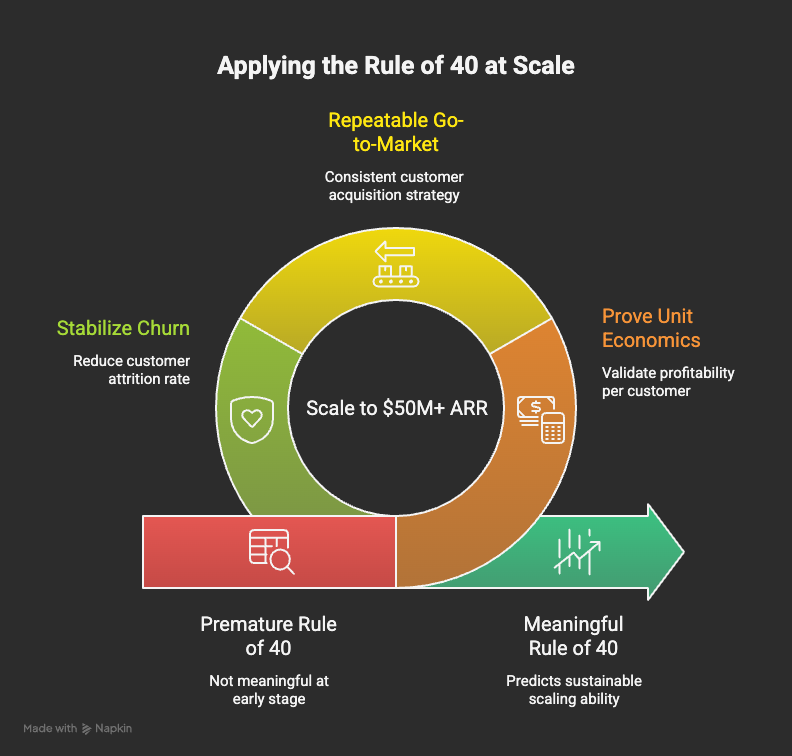

The Rule of 40 emerged from public market analysis of late-stage SaaS companies. It was designed for businesses doing $50M+ in ARR, usually post-Series C, often approaching or past $100M.

Why does scale matter? Because at that stage, you have enough data to make the metric meaningful. Your unit economics are proven. Your go-to-market motion is repeatable. Your churn is stabilized. You're no longer guessing, you're optimizing.

Below $10M ARR, the Rule of 40 is theater. You're still figuring out product-market fit, experimenting with channels, and probably burning cash to learn what works. Your growth rate might swing 30 percentage points quarter to quarter. Your margins are volatile because you're investing in foundational infrastructure.

Between $10M and $50M ARR, the Rule of 40 becomes increasingly relevant, but it's still not your North Star. You're scaling what works and pruning what doesn't. You should be watching it, but you shouldn't be optimizing for it yet.

Past $50M ARR, the Rule of 40 becomes critical. This is when investors, boards, and potential acquirers will judge your efficiency against this benchmark. This is when the metric actually predicts your ability to scale sustainably.

What to Focus on Instead (When You're Still Building)

If you're pre-$10M ARR, forget the Rule of 40. Seriously. It's a distraction.

Focus on these instead:

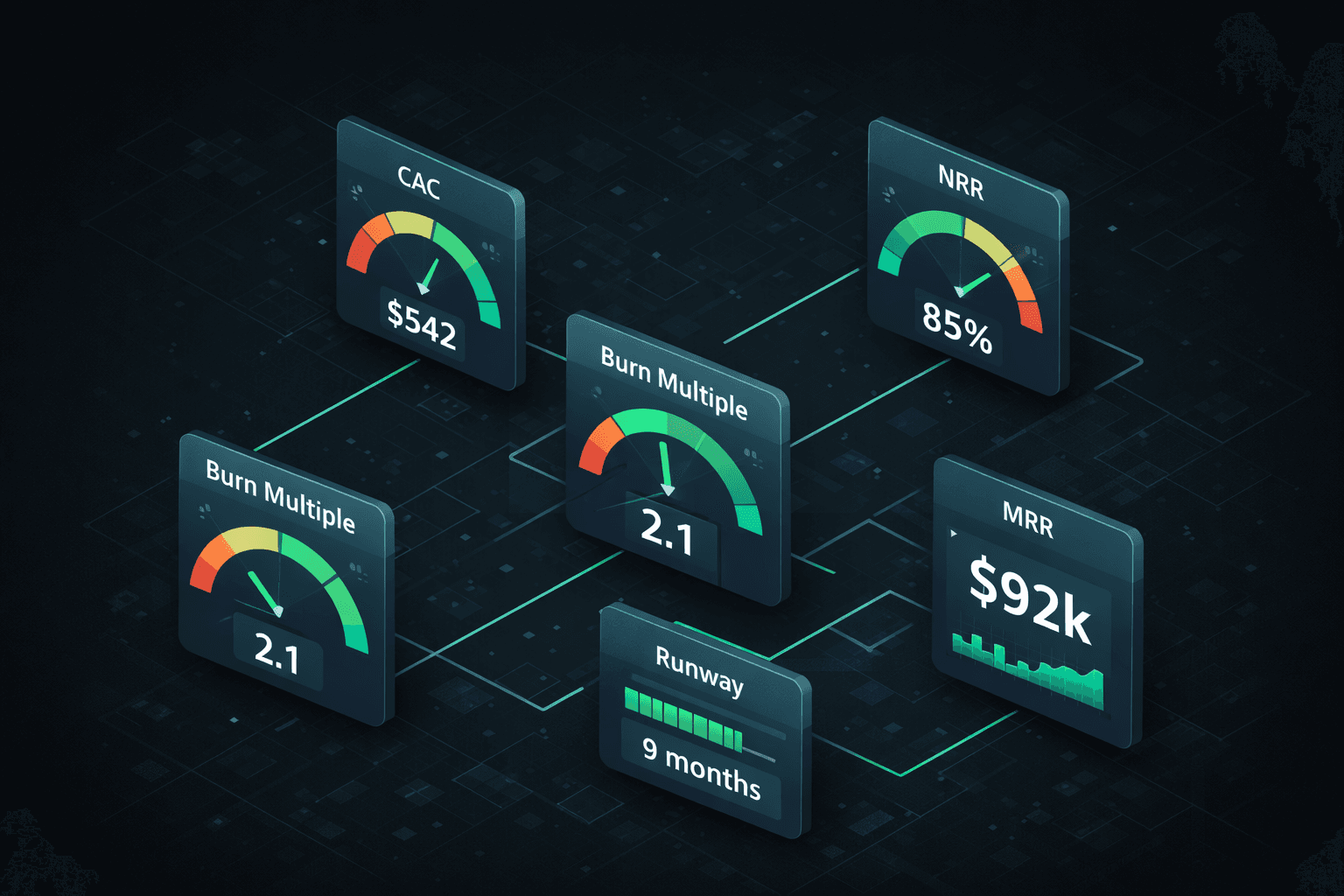

Customer Acquisition Cost (CAC) Payback Period: How many months does it take to recoup what you spent acquiring a customer? Under 12 months is healthy. Under 6 months is exceptional.

Net Revenue Retention (NRR): Are your existing customers growing with you? If you're above 100%, you have negative churn, your revenue grows even if you don't add new customers. This is the most important metric in early-stage SaaS.

Burn Multiple: How many dollars are you burning to generate each dollar of new ARR? Under 1.5x is good. Under 1x means you're extremely efficient. Above 3x means you're burning too hot.

Magic Number: Take your net new ARR in a quarter and divide it by your sales and marketing spend in the prior quarter. Above 0.75 is efficient. Above 1.0 is excellent.

These metrics tell you if your engine works. The Rule of 40 just tells you if your engine is balanced, but you need a working engine first. For a comprehensive look at how these metrics connect, explore our guide on runway, burn rate, and cash flow clarity.

The Trap of Premature Optimization

Here's where founders get into trouble: they hit $5M ARR, see their Rule of 40 is underwater at 20% growth and -30% margin, and panic. So they slam the brakes on spending to "improve the metric."

Bad move.

At $5M ARR, you should be investing aggressively if your unit economics work. You should be burning cash to learn faster, to test channels, to build the product moat that will matter at $50M. Optimizing for profitability at this stage often means sacrificing the learning that leads to efficient scale later.

The companies that win don't optimize for the Rule of 40 early. They optimize for learning velocity. They figure out repeatable, scalable growth. Then, when they hit $20M, $30M, $50M, they have the foundation to grow efficiently.

When to Start Caring (And What to Do About It)

Start tracking the Rule of 40 around $10M ARR. Don't optimize for it, just watch it.

Between $10M and $25M, you should see your path to 40. Your growth rate will naturally decline as you get larger (it's much easier to double from $5M than from $50M), so your margin needs to improve. This is when you start building real operational discipline.

Past $25M, you should be actively managing toward the Rule of 40. This means making conscious tradeoffs: do we invest another $1M in sales to accelerate growth, or do we let growth moderate and improve our margin? Both can be right, but you need to know which game you're playing.

By $50M, the Rule of 40 becomes a hard constraint. If you're below it, expect tough questions from investors. If you're above it, you have strategic flexibility to make big bets.

The Real Insight: It's About Trade-Offs

The Rule of 40 is useful not because it's a target, but because it forces you to think about tradeoffs.

Should you hire five more AEs to accelerate growth, even if it tanks your margin? Depends on where you are. At $5M, probably yes if your payback period is reasonable. At $50M, maybe not if you're already growing 40% and have a clear path to profitability.

Should you cut spending to improve your margin? Depends. If you're cutting waste, absolutely. If you're cutting the muscle that drives growth, you're making a dangerous bet.

The Rule of 40 doesn't give you answers. It gives you a framework for asking better questions about how you balance growth and profitability.

What Futureproof Shows You

Most founders track their Rule of 40 in a spreadsheet, updated quarterly, often with questionable accuracy. By the time you realize you're off track, you've lost months.

Futureproof gives you real-time visibility into your growth rate and margin, automatically calculated from your actual financial data. You see how every hiring decision, every marketing campaign, every pricing change affects your trajectory.

More importantly, you see your path forward. Our forecasting engine lets you model different scenarios: what happens to your Rule of 40 if you hire three engineers next quarter? If you increase pricing 15%? If you cut your CAC by 20%? Building a pro forma income statement helps you visualize how these decisions cascade through your entire P&L and affect your margin trajectory.

You can play out the tradeoffs before you make them. You can see your Rule of 40 trend line and know if you're building toward efficiency or just burning cash without a path to sustainability.

The Bottom Line

The Rule of 40 matters, but only when your business is mature enough for it to be meaningful.

If you're under $10M ARR, focus on building a repeatable growth engine with strong unit economics. Track your CAC payback, your NRR, your burn multiple. Make sure the fundamentals work.

Between $10M and $50M, watch the Rule of 40, but don't let it dictate your strategy. You should see a path to 40, but you shouldn't sacrifice growth to get there artificially early.

Past $50M, the Rule of 40 becomes a critical benchmark. You need to be above it or have a clear, credible plan to get there.

The companies that scale successfully understand this progression. They invest heavily early, learn fast, build the right engine, then optimize for efficiency as they scale. They don't confuse the metrics that matter at $5M with the metrics that matter at $50M.

Know where you are. Know what matters at that stage. And build accordingly.

That's how you create a business that doesn't just grow, but grows sustainably and becomes the kind of company that investors fight to fund.

For a practical guide to setting up the bookkeeping foundation that feeds these efficiency metrics, see our complete guide to bookkeeping for startups.

Ready to track the metrics that actually matter for your stage? Futureproof gives you real-time financial clarity, intelligent forecasting, and the insights you need to make smarter decisions. See your Rule of 40, CAC payback, burn multiple, and every other critical metric automatically calculated from your data, updated in real-time.

Start your free trial and see what financial clarity actually looks like.