If you're running a SaaS or subscription business, you already know churn is bad. Losing customers means losing revenue. Simple math.

Except it's not simple at all.

When a customer cancels their subscription, most founders calculate the loss as one month's payment. But that's not what you're actually losing. The real cost of churn is exponentially higher and most SaaS founders dramatically underestimate it until it's too late.

This is where understanding the Rule of 78 becomes critical. It's a financial principle that reveals the true, compounding cost of customer churn. And once you see it, you'll never think about retention the same way again.

What is the Rule of 78?

The Rule of 78 originated in the lending industry as a method for calculating how interest compounds over time. When applied to subscription businesses, it shows how customer losses compound and create exponential damage to your cash flow. For a complete framework on managing cash flow and other critical startup metrics, see our comprehensive guide on runway, burn rate, and cash flow clarity.

Here's the core principle: when you lose a customer, you're not just losing that month's revenue. You're losing every future payment that customer would have made for the entire duration they would have stayed with you.

The formula is straightforward. For a customer with a 12-month expected lifetime, add up the cumulative value of each month:

Month 1: 1

Month 2: 2

Month 3: 3

...continuing through...

Month 12: 12

Total: 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9 + 10 + 11 + 12 = 78

This means any monthly churn amount multiplied by 78 gives you the true 12-month cash flow impact of that loss.

How the Rule of 78 Reveals True Churn Cost

Let's look at a concrete example.

Say you have a customer paying $49/month who cancels after their first month. On your dashboard, you see -$49 in churned MRR. That feels manageable. You think, "We'll just replace them with a new customer next month."

But here's what you actually lost: $588 ($49 × 12 months).

That customer would have generated $49 every month for a year. When they cancel in month 1, you don't just lose one payment, you lose all twelve payments they would have made.

Now here's where it gets worse.

Why Churn Compounds Faster Than Growth

If losing one customer means losing $588, that's painful but survivable. The real problem isn't one customer, it's that churn happens every single month.

Most SaaS founders treat churn as a linear problem. They see their monthly churn number and think, "We'll offset it by acquiring more customers."

This is the trap that kills growth.

Churn doesn't work linearly; it compounds. Every month you maintain the same churn rate, you're not just creating new holes in your bucket. You're creating holes that get exponentially bigger over time.

The Math of Compounding Losses

Let's say you're losing $500 in MRR every month to churn. Maybe that's 10 customers at $50 each, or 5 customers at $100 each. The specific mix doesn't matter; what matters is that you're consistently bleeding $500/month.

Here's what's actually happening to your business:

Month 1: You lose $500/month in MRR

- That's $500 × 12 remaining months = $6,000 in annual revenue gone

Month 2: You lose another $500/month in MRR

- That's $500 × 11 remaining months = $5,500 more in annual revenue gone

Month 3: You lose another $500/month in MRR

- That's $500 × 10 remaining months = $5,000 more in annual revenue gone

This pattern continues every single month. Each new wave of churn creates a deficit for all the remaining months in the year.

By month 12, if you add up all the compounding losses:

$6,000 + $5,500 + $5,000 + $4,500 + $4,000 + $3,500 + $3,000 + $2,500 + $2,000 + $1,500 + $1,000 + $500 = $39,000

Or you can calculate it instantly using the Rule of 78:

$500 × 78 = $39,000

That's the true 12-month cash flow impact of losing just $500 in MRR every month.

Why You Can't Acquire Your Way Out of Churn

Now let's compare this to customer acquisition.

If you acquire a new $500/month customer, you gain $500 in MRR. Great! But that customer needs to stay for 78 months before they generate enough revenue to offset the compound losses from one year of $500/month churn.

Think about that: 78 months is 6.5 years.

Meanwhile, new customer acquisition is linear. You acquire one customer, you gain their monthly payment. You have to acquire and retain that customer for over six years before you recover what continuous churn cost you in just twelve months.

You can't outrun exponential losses with linear gains.

The Trap Most Founders Fall Into

This is why high-growth companies with poor retention eventually hit a wall. They look at their metrics and think:

"We're losing $2,000/month to churn, but we're adding $5,000/month in new MRR. We're growing net $3,000/month. We're fine."

But they're not fine. Because that $2,000/month churn isn't just $2,000. Over 12 months, it's:

$2,000 × 78 = $156,000 in lost cash flow.

To truly offset that, they'd need to acquire $156,000 in NEW annual contract value, not just $2,000/month in new MRR. And those new customers need to actually stay, which brings you right back to the retention problem.

This is the vicious cycle: spend more on acquisition to offset churn, which brings in customers who also churn, which requires even more spending on acquisition. The bucket keeps getting leakier, and you're running faster just to stay in place.

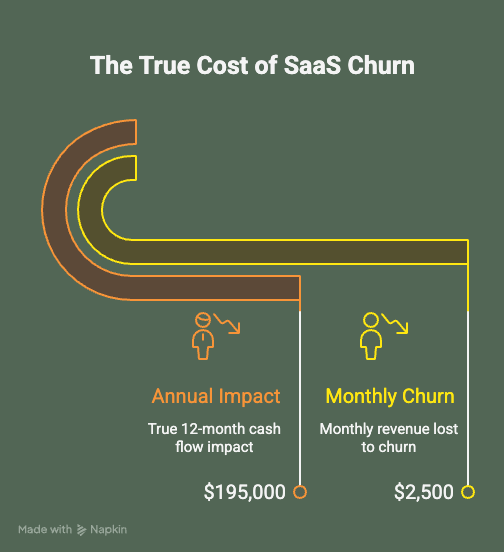

The Real Numbers Get Scary Fast

Let's look at a more realistic scenario for a growing SaaS company:

You're at $50,000 MRR with a 5% monthly churn rate (which many founders think is "acceptable").

Monthly churn: $50,000 × 0.05 = $2,500/month

True 12-month impact: $2,500 × 78 = $195,000

That's nearly $200,000 in lost cash flow over the next year from maintaining your current churn rate.

For context, that's:

- Two senior engineers for a year

- Your entire marketing budget

- 6+ months of runway for an early-stage startup

- The difference between profitability and burning cash

And this assumes your churn rate stays at 5%. If it increases to 7% as you scale (which often happens), you're losing $273,000 annually. At 10% churn, you're losing $390,000. To truly understand how churn affects your path to profitability, building a pro forma income statement can help you model how different retention scenarios impact your bottom line.

You cannot acquire your way out of this math.

What Makes Churn Different from Other SaaS Metrics

Churn vs. Customer Acquisition Cost (CAC)

When founders think about profitability, they often focus on CAC. How much does it cost to acquire a new customer? If you're spending $200 to acquire a $49/month customer, your payback period is about 4 months.

But here's what most founders miss: CAC is a one-time cost. Churn is a recurring loss that compounds over time.

If you acquire 10 customers at $200 each, you've spent $2,000 once. If you lose 10 customers per month at $49 each, you're creating a $38,220 cash flow hole over the next 12 months ($490 × 78).

This is why high-growth SaaS companies with poor retention eventually hit a wall. They can't acquire customers fast enough to offset the exponential losses from churn.

Churn vs. Monthly Recurring Revenue (MRR)

MRR is a snapshot metric. It tells you how much recurring revenue you have right now. Churn is a velocity metric. It tells you how fast that revenue is disappearing.

Two companies with the same MRR can have completely different trajectories:

Company A: $100,000 MRR, 2% monthly churn

Company B: $100,000 MRR, 5% monthly churn

Company A loses $2,000/month ($2,000 × 78 = $156,000 annual impact)

Company B loses $5,000/month ($5,000 × 78 = $390,000 annual impact)

Company B has a $234,000 larger hole in their cash flow over the next year just from the difference in churn rate. That's the cost of multiple engineers, a complete marketing budget, or the difference between profitability and shutdown.

Churn vs. Lifetime Value (LTV)

LTV measures how much revenue a customer generates over their entire relationship with you. But LTV is forward-looking; it's based on assumptions about how long customers will stay.

Churn is reality. It's what's actually happening to your customer base right now.

If your LTV calculations assume customers stay 24 months, but your actual churn data shows they're leaving at 8 months, your unit economics are fiction. You're building a business model on assumptions that don't match reality.

The Rule of 78 forces you to confront actual churn behavior and its true cost, not theoretical customer lifetimes.

What Drives High Churn in SaaS Businesses

Understanding what causes churn is the first step to reducing it. Most SaaS churn falls into three categories:

Product-Market Fit Issues

Customers sign up expecting one thing and get another. Or they sign up before they truly need your solution. This typically shows up as early churn, customers leaving within the first 3 months.

Red flag: High churn in months 1-3, especially if customers aren't engaging with core features.

Onboarding and Activation Failures

Customers want to succeed with your product but can't figure out how to get value from it. They don't understand the features, can't integrate with their workflow, or get stuck without support.

Red flag: Customers who never complete key activation milestones (first project created, first integration connected, first report generated).

Value Erosion Over Time

Customers start strong but gradually use the product less. This happens when products don't evolve with customer needs, when competitors offer better solutions, or when customers outgrow your product's capabilities.

Red flag: Declining usage metrics (logins, feature usage, team members active) 30-60 days before cancellation.

How to Calculate Your True Churn Cost

Here's how to understand what churn is actually costing your business:

Step 1: Calculate Your Monthly Churn in Dollars

Look at your last 3 months of cancellations. Add up the MRR lost each month and find the average.

Example: Month 1: $800, Month 2: $650, Month 3: $750

Average monthly churn: $733

Step 2: Apply the Rule of 78

Multiply your average monthly churn by 78.

$733 × 78 = $57,174

This is your 12-month cash flow impact from your current churn rate.

Step 3: Annualize the Impact

Multiply your monthly churn by 12, then multiply that by 78.

$733 × 12 = $8,796 in annual churned MRR

$8,796 × 78 = $686,088

This is the true cost of maintaining your current churn rate for a full year.

Step 4: Calculate Your Churn Opportunity

Now calculate what you'd gain by reducing churn:

If you reduced churn by 25%:

$733 × 0.25 = $183.25 in monthly churn reduction

$183.25 × 78 = $14,293.50 in recovered annual cash flow

If you reduced churn by 50%:

$733 × 0.50 = $366.50 in monthly churn reduction

$366.50 × 78 = $28,587 in recovered annual cash flow

Suddenly, investing $5,000-$10,000 in retention initiatives doesn't seem expensive, it seems like the highest ROI investment you could possibly make.

Strategies to Reduce SaaS Churn

Once you understand the true cost of churn, the next question is: how do you fix it?

Improve Onboarding and Time-to-Value

The faster customers see value, the less likely they are to churn. Focus on:

- Activation checklists that guide new users to first success

- Onboarding emails that educate and encourage engagement

- In-app guidance that helps users discover key features

- Success milestones that celebrate progress and reinforce value

Target metric: Get 80% of customers to complete core activation within 7 days.

Implement Early Warning Systems

Don't wait for cancellation emails. Identify at-risk customers before they decide to leave:

- Usage monitoring: Flag accounts with declining engagement

- Feature adoption tracking: Identify customers not using key features

- Support ticket patterns: Watch for frustration signals

- Payment failures: Catch billing issues before they become cancellations

Target metric: Identify at-risk customers 30 days before they typically churn.

Build Proactive Retention Workflows

Once you identify at-risk customers, intervene:

- Personal outreach from customer success team

- Educational content showing underutilized features

- Use case recommendations based on similar successful customers

- Discount offers for customers with budget constraints (use sparingly)

Target metric: Re-engage 40% of at-risk customers before they cancel.

Gather and Act on Cancellation Feedback

When customers do cancel, learn why:

- Exit surveys that identify primary cancellation reasons

- Cancellation interviews with high-value customers

- Win-back campaigns for customers who might return later

- Product roadmap input from recurring cancellation themes

Target metric: Get feedback from 60% of churned customers.

Create Expansion Revenue Opportunities

The best defense against churn is making your product more valuable over time:

- Feature expansion that grows with customer needs

- Team-based pricing that increases value as companies scale

- Premium support tiers for customers who need extra help

- Usage-based pricing that aligns cost with value delivered

Target metric: Achieve 110%+ Net Revenue Retention (expansion revenue offsets churn).

When to Prioritize Retention Over Acquisition

Early-stage SaaS companies often face a dilemma: should we focus on acquiring more customers or retaining the ones we have?

The answer depends on your current metrics:

Prioritize Retention When:

- Monthly churn rate exceeds 5%

- Customer lifetime is under 12 months

- CAC payback period is longer than 6 months

- Most customers aren't reaching activation milestones

- NRR (Net Revenue Retention) is below 100%

Prioritize Acquisition When:

- Monthly churn rate is under 3%

- Customer lifetime exceeds 24 months

- Strong product-market fit with clear activation

- Healthy unit economics (LTV:CAC ratio above 3:1)

- NRR is above 110%

Most SaaS companies under $1M ARR should split focus: 70% on retention, 30% on acquisition. Once retention is strong, flip to 30% retention, 70% acquisition.

The Bottom Line on SaaS Churn

Churn isn't just a metric. It's not just a percentage on your dashboard. It's an exponential force working against everything you're building.

Every customer you lose creates a compounding deficit in your cash flow. Every month you ignore retention, that deficit grows larger. And every dollar you spend on acquisition without fixing retention is a dollar that won't compound the way you expect.

But here's the opportunity: retention improvements compound too. Reduce churn by 25%, and you're not just saving this month's revenue, you're reclaiming tens of thousands in annual cash flow. That's money you can reinvest in product, hire that engineer you need, or extend your runway by months.

The companies that scale successfully don't accept churn as inevitable. They treat every lost customer as a compounding problem to solve. They invest in retention infrastructure before it becomes a crisis. And they understand that in SaaS, keeping customers isn't just cheaper than finding new ones, it's exponentially more valuable.

Track your churn and see how much cash flow you're leaving on the table. Sign up for a free trial.