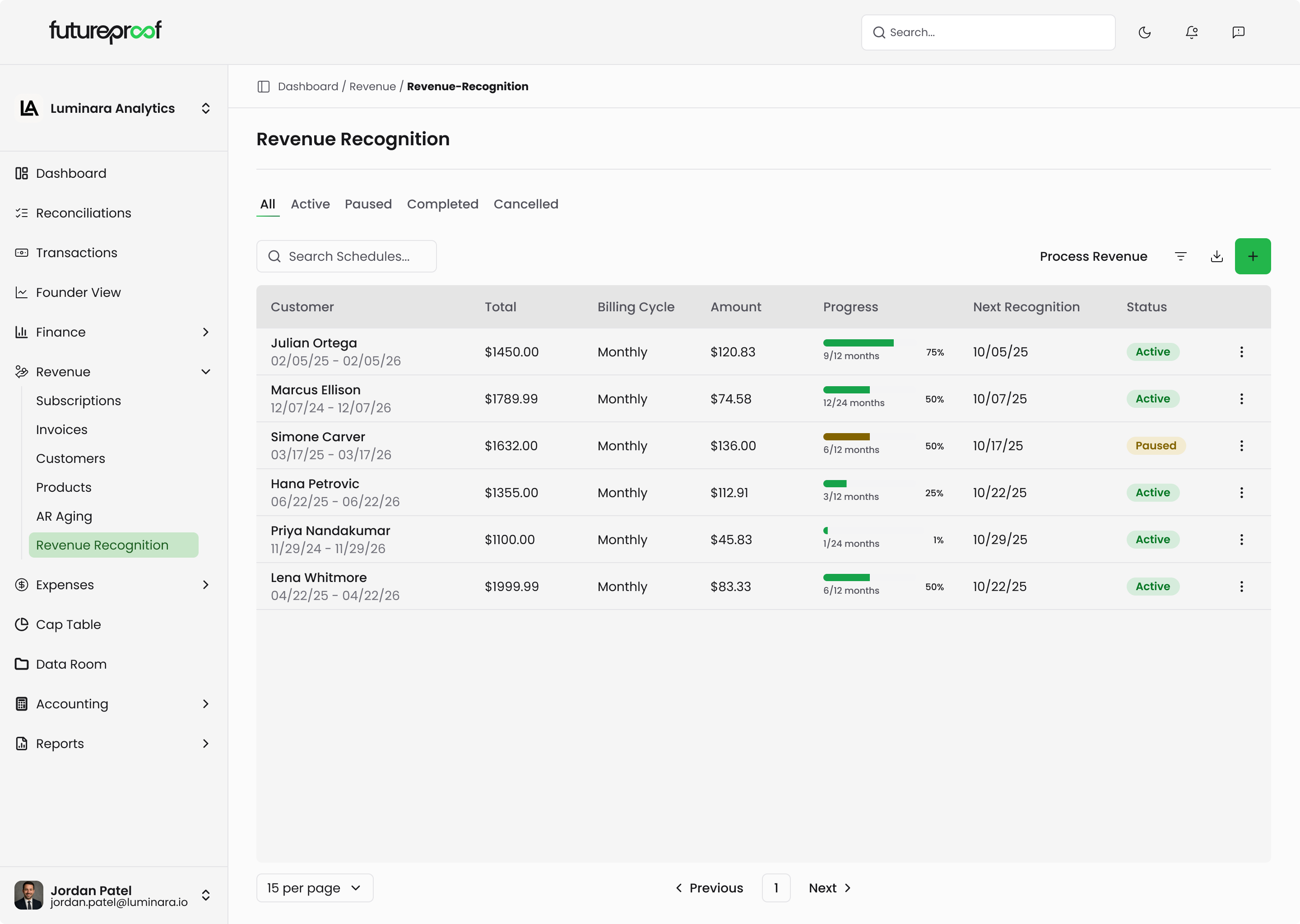

Stop manual journal entries. Start automated revenue recognition

Xero forces you to manually create journal entries for subscription revenue, deferred income, and contract billing. Futureproof automatically handles SaaS revenue recognition. No spreadsheets or manual calculations required.

Create journal entries for deferred revenue, manually calculate subscription recognition, spreadsheet reconciliation

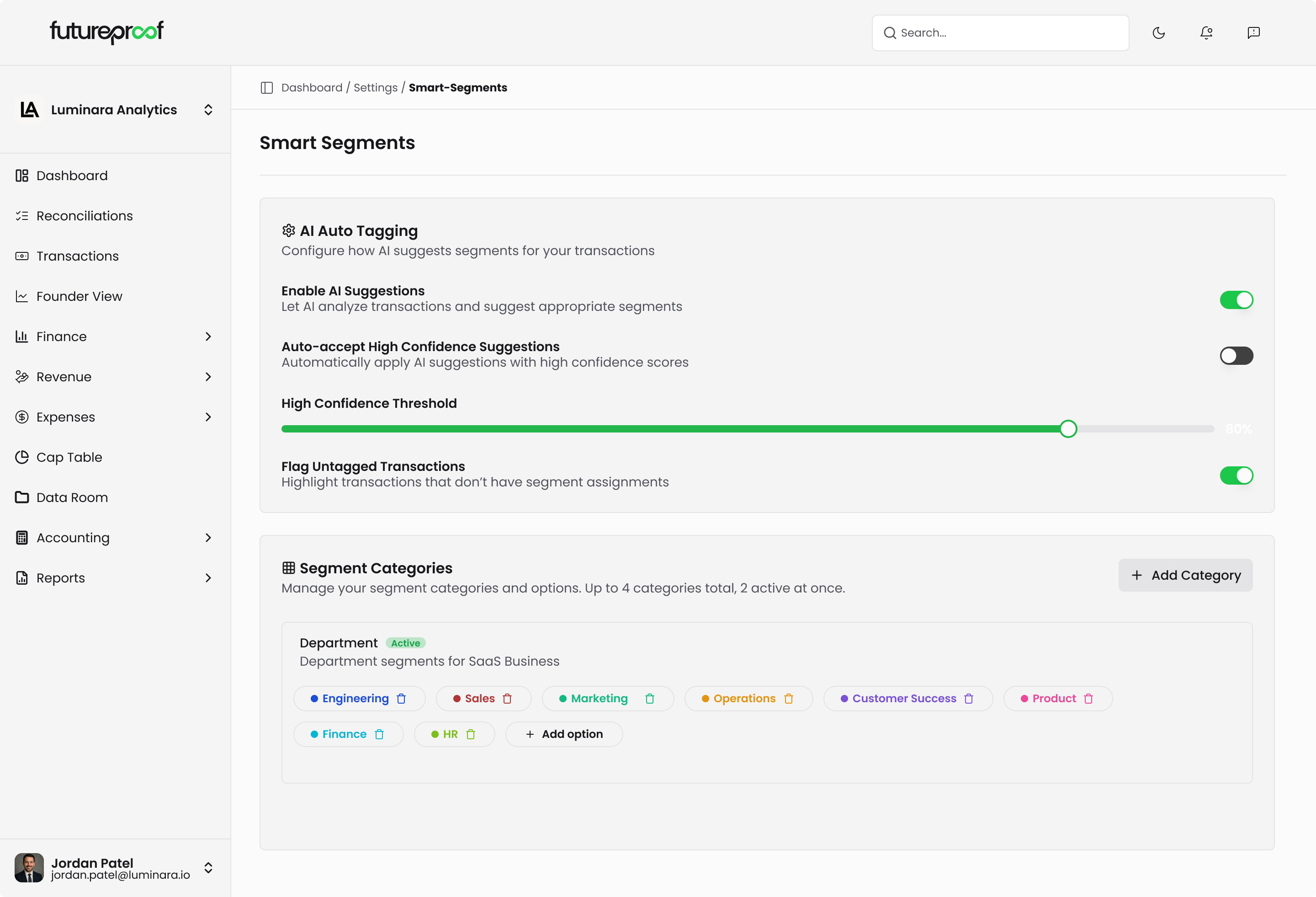

Ditch manual tracking categories. Embrace smart tracking

Xero makes you manually tag every transaction with predefined categories. Futureproof's smart tracking automatically discovers profitable customer segments, product lines, and acquisition channels using AI revealing insights you never knew to look for.

Create Department/Location categories, manually tag every transaction, analyze reports yourself

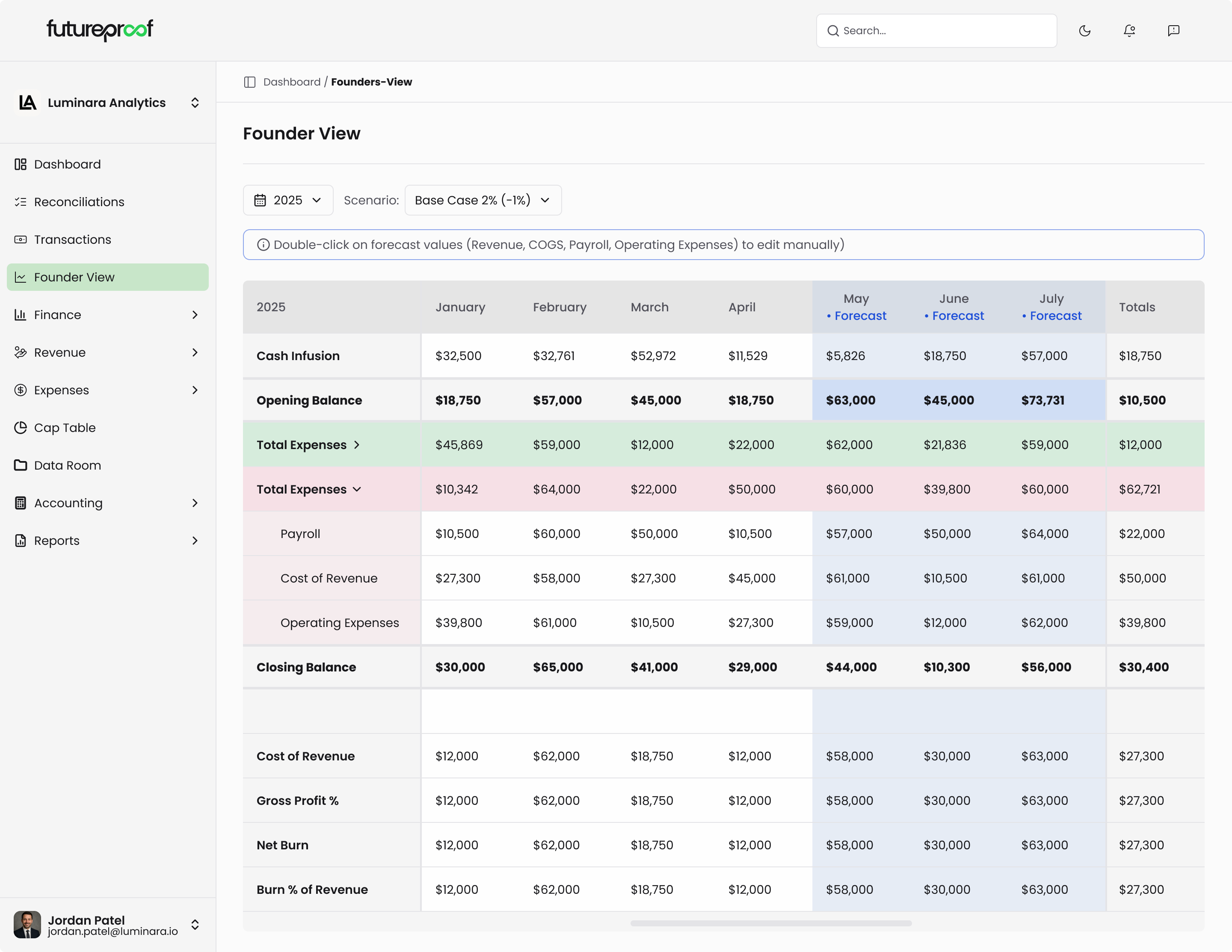

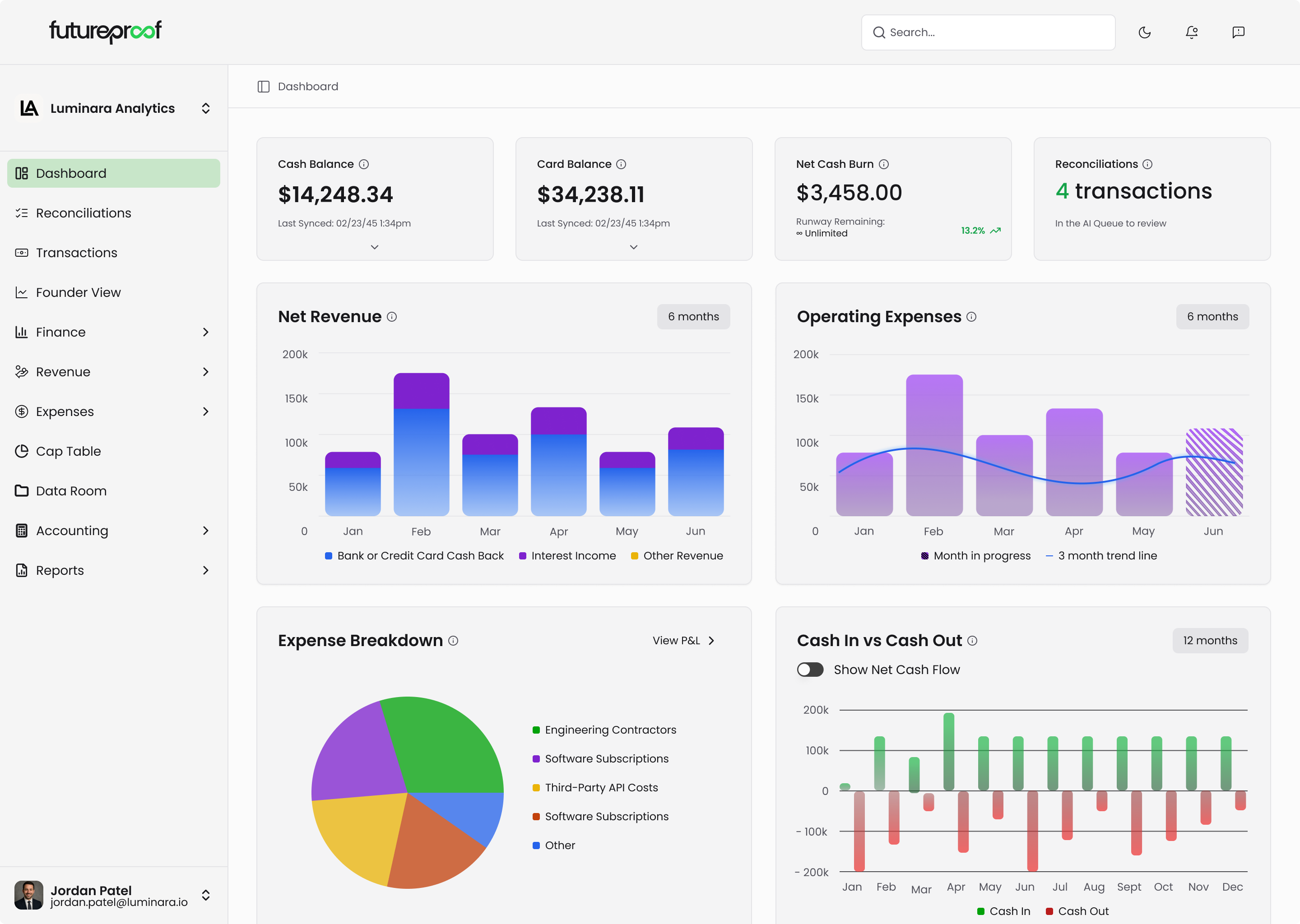

Track founder metrics, not just accounting metrics

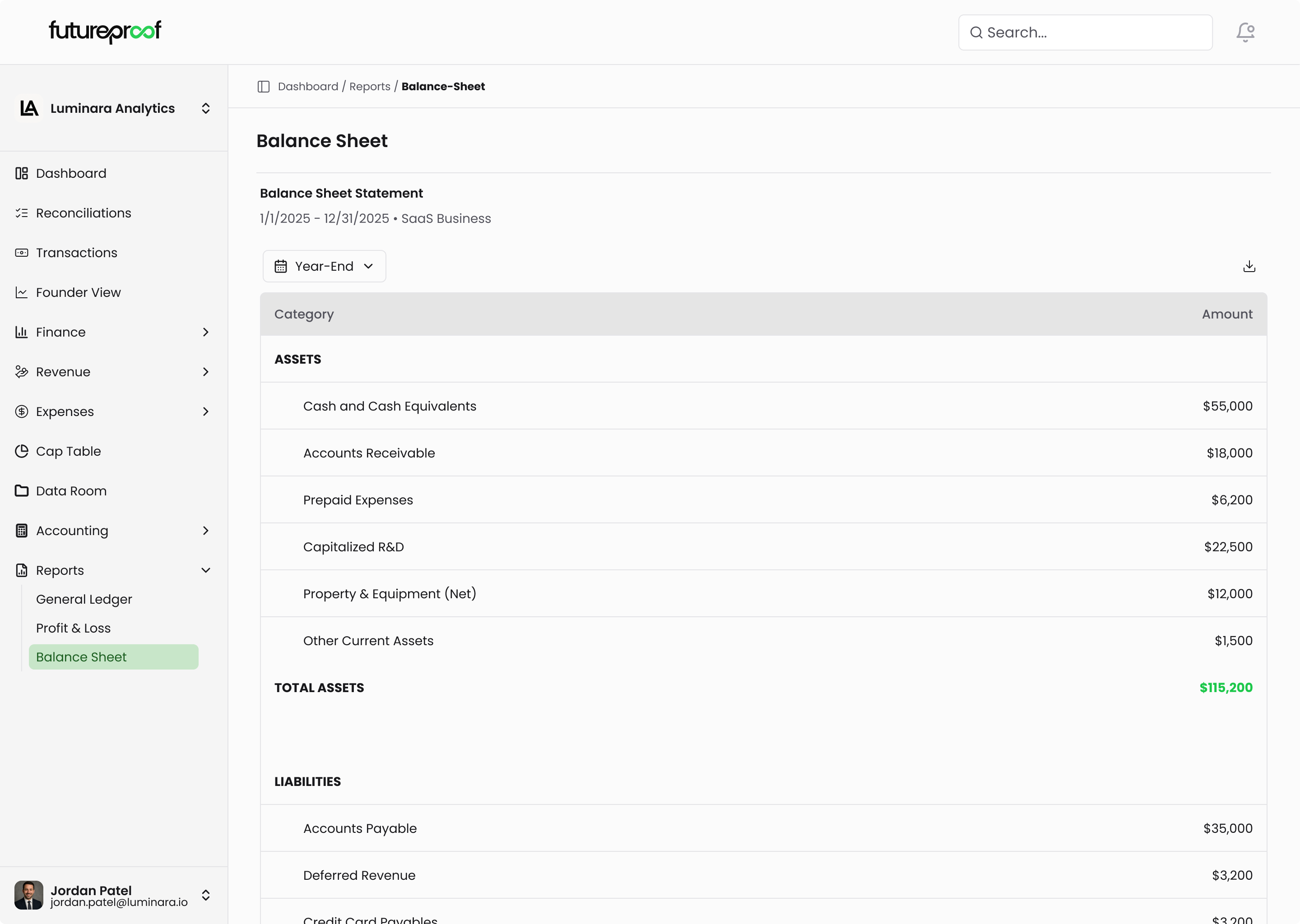

Xero gives you great P&L reports. Futureproof gives you the metrics that actually matter for scaling: burn multiple, LTV:CAC ratios, gross margins by segment, and runway calculations.

P&L, balance sheet, cash flow. Manual KPI calculations required.

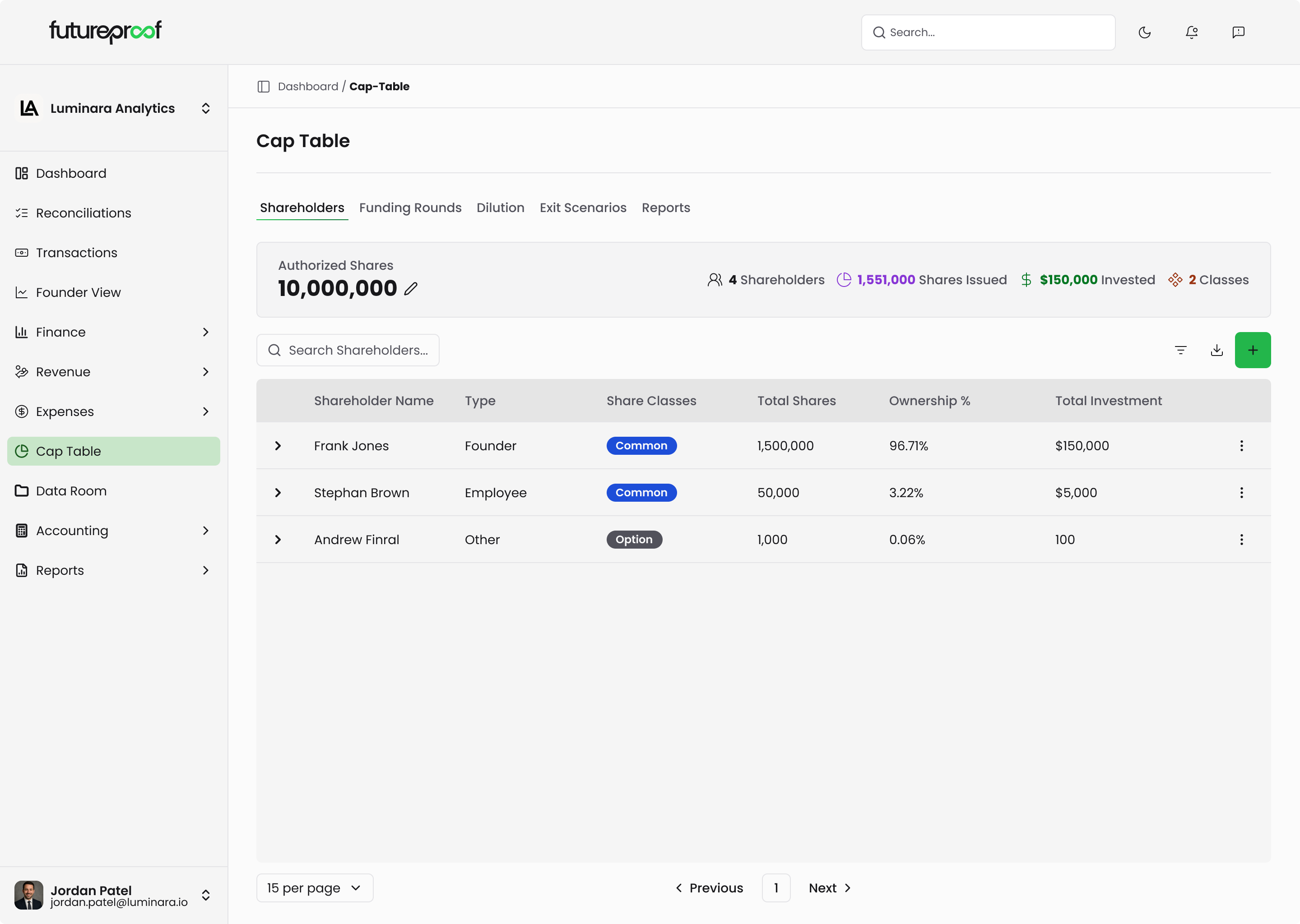

Your cap table, is as critical as your cash flow

Every funding round changes your ownership structure. Futureproof integrates cap table management with your automated revenue recognition, so you can model dilution scenarios and fundraising impact with real-time financial data.

Track SaaS metrics automatically, not manually

Xero gives you traditional accounting reports. Futureproof automatically calculates the metrics that matter for scaling SaaS companies: MRR, ARR, churn, LTV:CAC, gross margin by cohort—all updated in real-time from your automated revenue recognition.

Export P&L data, build spreadsheets for MRR tracking, manually calculate SaaS metrics

Fundraise with automated data rooms, not manual exports

When investors ask for financial data, Futureproof automatically generates investor-ready materials from your real-time revenue recognition and smart tracking data. No more exporting Xero reports and building decks manually.

.svg)

One automated platform not manual exports

With Xero, you need Carta for cap tables ($2,000+/year), spreadsheets for revenue recognition, and manual calculations for SaaS metrics. Futureproof automates it all in one platform with unified, real-time data.

Xero handles accounting well. Futureproof automates the entire financial operation. When you're ready to eliminate manual journal entries and discover hidden profit drivers automatically, make the upgrade.

Got Questions?

We’ve Got Answers.

I'm already comfortable with Xero. What would actually change for me?

Can Futureproof replace Xero entirely, or do I need both?

What if I have a bookkeeper or accountant who uses Xero?

Does this work with my billing setup (Stripe, annual contracts, usage-based)?

How long does migration take, and will I lose historical data?

What founder metrics does Futureproof track that Xero doesn't?

Can I test automated operations alongside my current Xero setup?

Does automated revenue recognition work for complex SaaS billing models?

.svg)