You're at the grocery store at 11:42 p.m., blurry-eyed from back-to-back investor calls, staring at your receipt wondering...

"Can I charge this to the business?"

It's not just you. Every founder hits this wall.

Rent, meals, new gear, plane tickets--startup life blurs the line between personal and business expenses fast.

But before you reach for the company card, stop.

Because this isn't just about receipts.

It's about how you lead.

Legal Rules Won't Save You--Judgment Will

The IRS says you can only expense what's "ordinary and necessary" for the business.

Sounds reasonable. Until you realize there's no glossary of what "ordinary" means for a founder sleeping under their desk, eating protein bars, and pitching between airport gates.

Truth: Legal rules are written for companies with departments and desks not for you, the one-person army bootstrapping with a dream.

What matters more than perfection is effort. If you're operating in good faith and not gaming the system, you're in the zone where most early-stage founders live and survive.

Think Like You're in the Wilderness

Imagine you're out in the wild, building a fire.

You've got limited wood. Every stick counts. Use it to boil water? Smart. Use it to roast marshmallows while your team's dehydrated? That's how people die out here.

Startup money is no different. You're building something in harsh conditions. You need to ration your fire, aka your capital or cash, wisely.

The wrong move can burn through your runway. The right one keeps your crew alive another week.

Good Expense Calls Start with Ethics

Ethics isn't about being perfect. It's about staying aligned with your mission when no one's watching.

So ask yourself:

- Does this help me grow the business?

- Would I be proud to explain this to an investor?

- Am I doing this for the company or for my own comfort?

Answer honestly. That's your compass.

What Not to Do

Let's be blunt:

- Don't treat your startup like your sugar daddy.

- Don't wrap personal perks in business excuses.

- Don't pull tricks just to dodge taxes or pump lifestyle while keeping your salary low.

That's how companies crumble before they start. And how founders get reputations that stick long after they've exited the cap table.

What Most Founders Actually Expense

If you're pre-Series A and making ethical, practical calls, here's what's commonly charged:

- Rent: When your apartment doubles as HQ.

- Meals: While working or meeting partners.

- Travel: To chase customers, investors, or key hires.

- Gear and tools: Anything that supports speed, survival, or shipping.

These aren't luxuries. They're necessities when you're building with limited resources.

If you're not paying yourself much (or anything), it's fair to cover basic needs that allow you to stay focused. But if you're pulling a fat salary and expensing personal stuff? That's not founder hustle; that's mismanagement.

The Two-Stage Mindset: Survive First, Comply Later

Early on, your job is to make ethical decisions that keep the mission alive.

You won't get every tax detail right, and that's okay. The IRS cares far more about fraud than founder fatigue.

They want to catch people exploiting the system, not those grinding it out to make payroll.

But know this: The bar rises as you grow.

Seed stage? Ethics and practicality.

Series A+? Full compliance, sharp books, no excuses.

Build the habits now, and the transition is smooth. Ignore them, and you'll be scrambling when due diligence hits. As your company matures, bringing in fractional CFO support can help you navigate the transition from scrappy survival mode to investor-ready financial operations.

Every Dollar Tells a Story

Every time you use company funds, you're writing a story about your leadership.

Will it read: _"Frugal, focused, mission-first?"

_Or: "Confused priorities, loose controls, self-serving?"

The IRS might never ask. But your future investors, board members, and team will.

So the next time you wonder, "Can I expense this?"

Flip the question: "Does this help the company survive, grow, or win?"

If yes: log it, own it, move on.

If no: pay out of pocket and sleep well.

Final Thought

The best founders don't need a checklist of what's allowed.

They've got an internal compass.

Follow yours. The kind of company you build starts here.

For the most peace of mind, have a chat with a tax attorney as this is not legal nor tax advice, just some rules of thumb from founder to founder.

For the full picture of how to manage your startup's books ethically and effectively at every stage, see our complete guide to bookkeeping for startups.

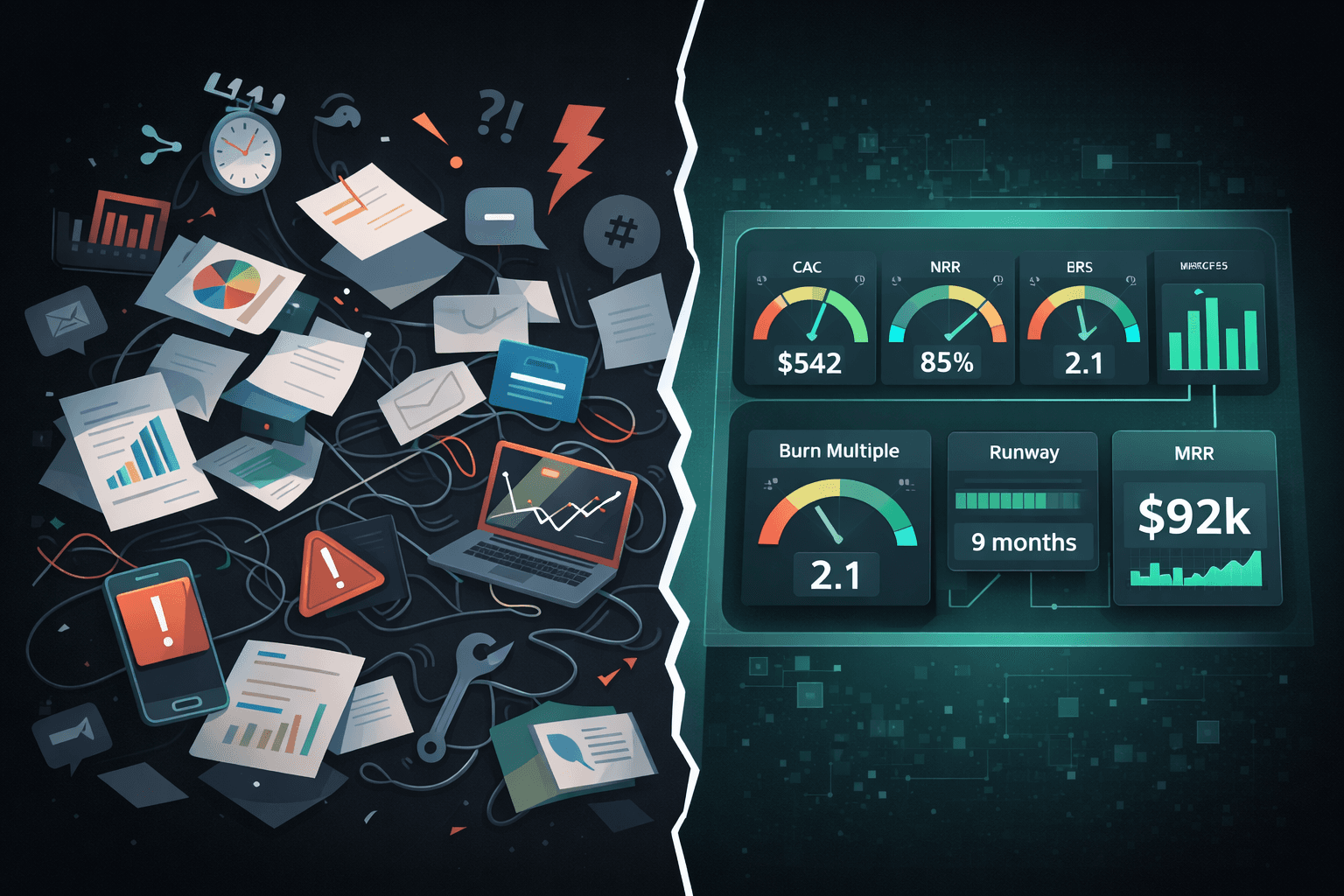

When you're in the thick of building, every dollar matters--and so does every decision. Futureproof gives you real-time visibility into your burn, runway, and expenses, so you can make smart, ethical calls without second-guessing. If you're tired of flying blind, start your free trial today and run your business with clarity, not chaos.