Ever tried to forecast your startup's future and felt like you were writing fan fiction?You're not alone. Pre-revenue financial modeling is equal parts art, science, and make-believe. But if you do it right, you won't just be making up numbers, you'll be crafting a hard sci-fi narrative rooted in logic, not waving a wand like a fantasy wizard hoping "number go up."

This is the founder's cheat code: Use fiction. Build conviction. Show traction before it's real. For a comprehensive framework on building models that investors actually believe, see our complete guide on startup financial modeling, forecasting, and planning.

Let's break down why every founder, especially if you're pre-revenue needs a killer financial model, and how to build one that actually helps you (and doesn't make investors roll their eyes).

Step 1: Stop Pretending It's About Accuracy

Your model isn't meant to predict the future. It's meant to reveal what needs to be true for your vision to work.

Yes, you're "making it up." But here's the catch: good founders build models with rules, logic, and constraints like hard science fiction. Bad founders scribble fairy tales with hockey-stick charts and zero friction.

The discipline of modeling forces clarity:

- Can you really scale that fast?

- Do your margins hold up under growth?

- Are you about to accidentally create a business that loses more the more it sells?

Fantasy founders ignore these. SaaS and ecommerce killers embrace them.

Step 2: Show the Scale But Keep It Sane

Investors want big outcomes. You want life-changing wins. But how you show it makes all the difference.

Projecting $100M ARR in 5 years is cute until you realize it assumes 90% global market share, 0% churn, and one employee doing all the work.

**Pro Tip:

**Look at your assumptions under a microscope:

- How many customers do you need?

- What does churn look like?

- What's your CAC by channel?

- How many reps or team members would be required?

Most founders overestimate revenue and underestimate headcount. They think they'll do Stripe's revenue with a Notion doc and a VA. Nope. Build it out and see what breaks.

Step 3: Use the Model to Justify Your Fundraise

Raising $1M? Why? For what? A solid model doesn't just forecast revenue, it shows when you'll run out of cash and what happens if you raise or don't.

Instead of "we need $1M to grow," you can say:

"If we raise $1M by Q3, we can hire 2 AEs and a demand gen lead, which should bring in $50K MRR within 6 months based on channel benchmarks."

Now you're not pitching dreams. You're pitching experiments.

Founders who treat their model as a strategy lab walk into investor meetings with leverage. Founders who don't They wing it. And winging it rarely wins.

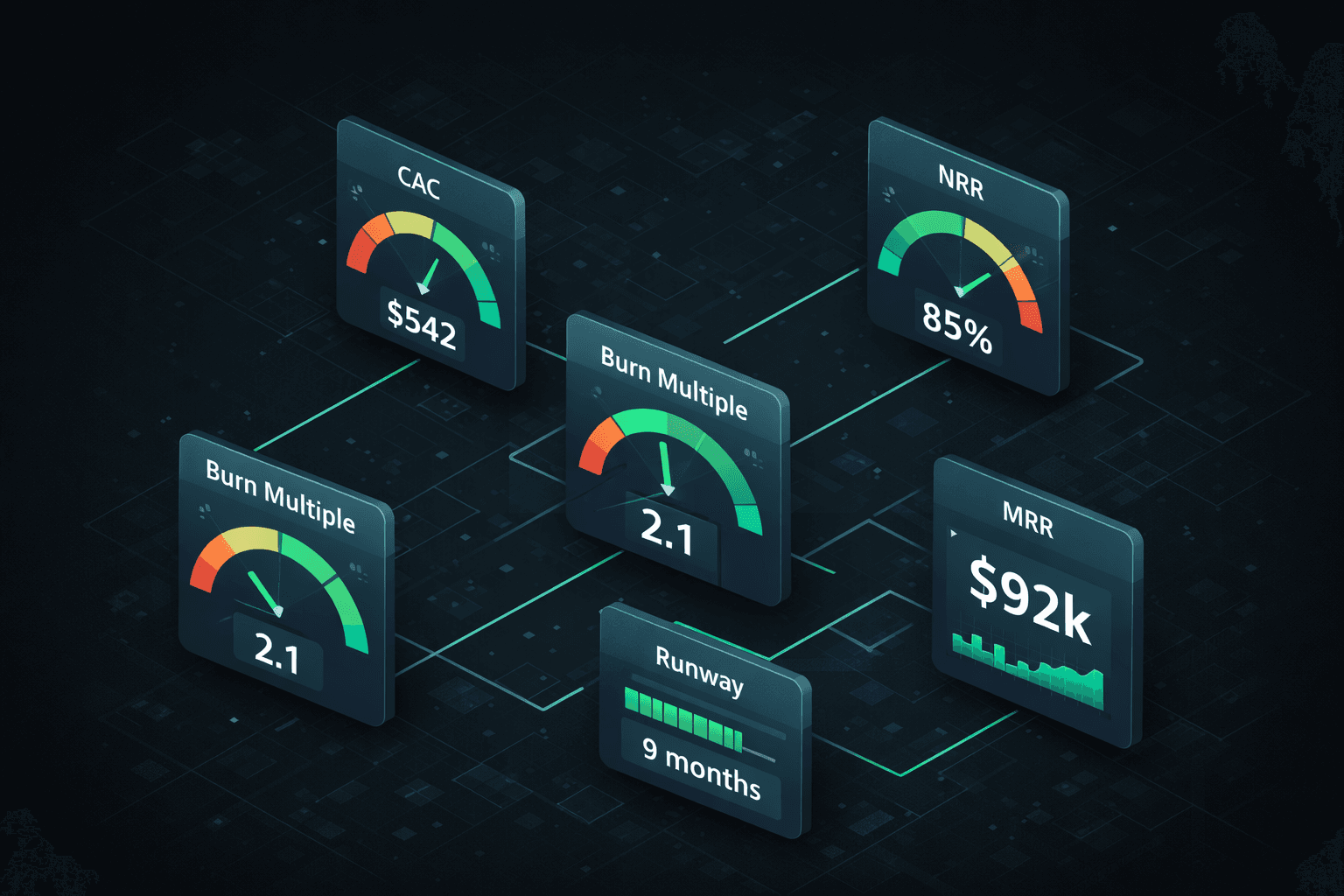

Step 4: Pressure Test Your Unit Economics

Let's say you sell a product for $100.

If your COGS is $60, CAC is $80, and your churn is sky-high...Congrats! You're scaling losses. Not a business.

A great model lets you play with the dials:

- Raise price? CAC still work?

- Drop price? Conversion jump enough?

- New ad channel? Better LTV?

Instead of guessing, you can game out what works and where it breaks. Founders often skip this. They get early wins, feel good, and assume it'll scale. But what they're scaling is a leaky bucket. Your unit economics are your business engine. Model them. Stress-test them. Know them cold.

Step 5: Play the Long Game, Even at Zero Revenue

Don't wait for revenue to start building your financial model. Waiting means you're reactive. Modeling means you're thinking ahead.

You don't need a finance degree or a fractional CFO just yet. What you need is a founder's mindset:

"If I had 1,000 customers… how would this look?"

"If I scaled my team… how fast would burn rise?"

"If CAC doubled… would I survive?"

This is how founders become CEOs. They stop reacting and start architecting.

Action Steps for Founders

Let's bring this down to ground level:

- Start with your revenue model. SaaS? Know your pricing, churn, and LTV. Ecommerce? Know your AOV, repeat purchase rate, and COGS.

- Build assumptions, not predictions. These are levers, not certainties.

- Create scenarios. Best case, base case, worst case. Play with them.

- Look for the "break points." Where does the math collapse? Fix those areas.

- Use your model as a fundraising tool. Show where the money goes, and what happens next.

- Build your pro forma income statement to project revenue, expenses, and profitability across multiple scenarios.

Pre-Revenue Reflection

Pre-revenue models are fiction. But not all fiction is worthless. Write hard sci-fi, not fantasy fluff. Show logic. Build tension. Reveal what's possible.

A startup without a model is like a spaceship with no flight plan drifting toward a black hole of burn with no idea when the oxygen runs out. Get your numbers in line. Get your story straight. And don't wait for revenue to start thinking like a CFO.

Planning your cap table is part of the model. Use our equity dilution calculator to see how SAFEs, option pools, and future rounds will reshape your ownership.

Most founders wait until they have revenue to think like a CFO but the smart ones model the future before it arrives. If you're serious about scaling your SaaS or ecommerce business, don't build your startup on fantasy. Build it on insight. Futureproof gives you the tools to model, stress test, and forecast your business with the same clarity investors expect. Try it free and get started in minutes.