Introduction: The Hidden Crisis in SaaS Financial Management

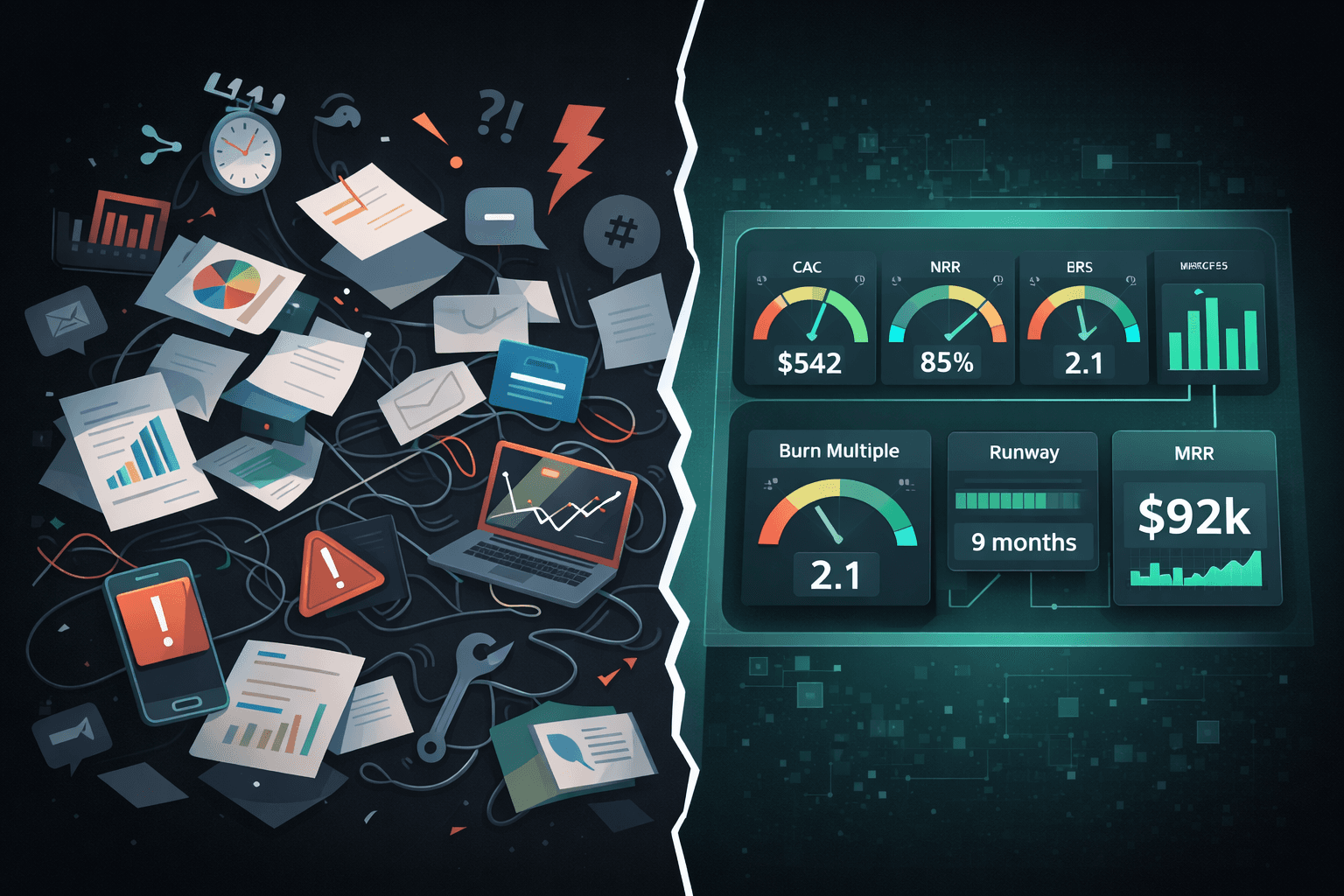

As a SaaS founder, you're building the future yet you're forced to manage finances like it's 1995. Between juggling spreadsheets, chasing bookkeepers for updates, and stitching together multiple tools that don't talk to each other, you're spending precious time on financial busywork instead of growing your business.

The traditional choice between "hire a bookkeeper" or "buy QuickBooks" is a false dilemma. Both options were designed for traditional businesses, not the unique needs of SaaS companies. And the cost of getting it wrong, missed tax filings, inaccurate investor reports, or running out of cash unexpectedly can be catastrophic.

This guide examines why conventional approaches fail SaaS companies and explores how modern, AI-powered platforms are revolutionizing financial operations for founders who refuse to accept the status quo.

The Unique Financial Challenges of SaaS

SaaS financial management isn't just accounting, it's the intelligence layer that drives strategic decisions. Traditional solutions fail because they don't understand these fundamental differences:

Metrics That Actually Matter While traditional businesses track simple revenue and expenses, SaaS companies live and die by MRR growth, churn rates, CAC payback periods, and burn multiples. Generic accounting software treats these as afterthoughts, if at all.

Real-Time Decision Making In SaaS, waiting until month-end to know your cash position is like driving while looking in the rearview mirror. You need instant visibility into runway, burn rate, and scenario planning not historical reports.

Exponential Complexity Growth A traditional business might double transactions when doubling revenue. SaaS companies face exponential complexity: more pricing tiers, usage-based billing, multi-currency transactions, and deferred revenue calculations that would make a CPA's head spin.

Investor-Grade Reporting from Day One VCs expect sophisticated financial analysis even from seed-stage companies. They want cohort analyses, unit economics, and detailed forecasting, not just a P&L statement.

Why Traditional Bookkeepers Are Failing SaaS Founders

The bookkeeper model worked when businesses were simpler. Today, it's holding SaaS companies back:

The Knowledge Gap Most bookkeepers cut their teeth on retail or service businesses. When you explain SaaS metrics, you get blank stares. They can balance your books, but they can't tell you if your unit economics are healthy or your burn multiple is concerning.

The Speed Problem Traditional bookkeepers work on monthly cycles. By the time you get last month's financials, you're already halfway through the current month. In a fast-moving startup, this delay can be the difference between course-correcting and crisis.

The Scaling Nightmare Bookkeeper costs scale linearly with complexity. What starts at $500/month balloons to $2,000+ as you add entities, currencies, and transaction volume. Suddenly, you're spending engineering salary money on backward-looking reports.

The Single Point of Failure When your bookkeeper goes on vacation, gets sick, or quits, your financial operations grind to a halt. You're dependent on one person who holds critical knowledge about your business in their head, not in documented systems.

For a deeper look at how fractional CFO services compare to traditional bookkeeping and when it makes sense to upgrade your financial leadership, we've put together a comprehensive guide.

Why Traditional Software Alone Isn't Enough

Switching to software-only solutions like QuickBooks or Xero might seem like the answer, but it creates new problems:

The Integration Nightmare You end up with a Frankenstein's monster of disconnected tools: QuickBooks for bookkeeping, Excel for forecasting, Carta for cap table, DocSend for investor updates. Hours wasted on manual data transfer and reconciliation between systems.

The Expertise Vacuum Software can process transactions, but it can't provide strategic insights. You still need to understand debits and credits, tax implications, and accounting principles. It's like giving someone Photoshop and expecting them to become a designer.

The Configuration Complexity Setting up accounting software properly requires expertise most founders don't have. Incorrect setup compounds over time, creating massive cleanup projects when you eventually hire professionals.

The Missing Intelligence Layer Traditional software is dumb. It can't learn your business patterns, automatically categorize transactions intelligently, or alert you to concerning trends. You get features, not intelligence.

The Modern Solution: AI-Powered Financial Operations

The future of SaaS financial management isn't choosing between humans and software; it's leveraging AI to get the best of both worlds while eliminating the downsides.

Here's what modern financial operations look like:

Intelligent Automation That Learns AI doesn't just follow rules, it learns your business patterns. It knows that AWS charges are infrastructure costs, that Zoom is a productivity tool, and that founder expenses need special handling. The more you use it, the smarter it gets.

Real-Time Everything Modern platforms provide instant visibility into all critical metrics. Cash runway updates daily. Burn rate calculations reflect today's reality. Scenario planning happens in real-time, not quarterly.

Unified Intelligence Platform Instead of stitching together multiple tools, modern solutions unify all financial operations: bookkeeping, forecasting, cap table management, and investor reporting in one intelligent platform.

Cost Structure That Scales Here's what most accounting software companies don't want you to know: they profit from your complexity, not your success. Traditional platforms charge based on transactions, bills processed, or expense volume; meaning the more you spend, the more they make. It's a perverse incentive where your accounting costs balloon precisely when you're trying to manage burn.

Modern AI-powered platforms flip this model. Instead of penalizing growth through transaction fees, they align pricing with your revenue success. When you grow from $10K to $100K MRR, your transaction volume might 10x, but intelligent pricing scales with your revenue, not your expense complexity. This means you're investing in financial intelligence as you succeed, not getting nickel-and-dimed for every new vendor or expense report.

The result? Predictable costs that scale with your success, not your struggles. Your financial operations platform becomes a growth partner, not a tax on complexity.

What to Look for in a Modern Financial Operations Platform

As you evaluate solutions, prioritize these capabilities:

Intelligent Bookkeeping

- AI-powered categorization that learns from your corrections

- Multi-dimensional tagging (by department, project, customer segment)

- Automatic reconciliation across all accounts

- Smart alerts for unusual patterns or concerning trends

Native SaaS Intelligence

- Built-in SaaS metrics (MRR, ARR, churn, LTV, CAC)

- Cohort analysis without spreadsheet gymnastics

- Revenue recognition that handles complex subscription scenarios

- Burn rate and runway calculations updated daily

Integrated Planning & Analysis

- Scenario modeling for hiring, pricing, and fundraising decisions

- Cap table modeling with SAFE conversions and dilution impacts

- Department-level budgeting with approval workflows

- Board-ready reporting generated instantly, not manually

Stakeholder Accessibility

- Investor portals for secure document sharing

- Employee equity visibility for team members

- Read-only access for advisors and board members

- API access for custom integrations

Implementation: From Chaos to Clarity

Modern platforms dramatically simplify implementation:

Week 1: Intelligent Setup

- AI analyzes your historical data to suggest chart of accounts

- Automatic bank connections and historical imports

- Smart categorization begins learning immediately

- Basic dashboards populate automatically

Week 2: Customization

- Refine AI categorizations to match your preferences

- Set up department and project tracking

- Configure SaaS-specific metrics

- Connect revenue and payment systems

Month 1: Full Operation

- AI handles 95%+ of categorization automatically

- Real-time dashboards replace manual reporting

- Forecasting models built on actual data patterns

- Team members access relevant views

Ongoing: Continuous Intelligence

- AI accuracy improves with every transaction

- New insights surface automatically

- Scaling happens without additional setup

- Strategic focus replaces tactical busywork

The ROI of Modern Financial Operations

The value extends far beyond cost savings:

Time Recovered Founders report saving 10-20 hours monthly on financial tasks. That's 2-3 weeks annually returned to product development and growth.

Decision Velocity Real-time insights enable faster, more confident decisions. No more waiting for month-end to understand your position.

Fundraising Readiness Always-ready investor reports and metrics mean you can capitalize on opportunities without scrambling to prepare materials.

Error Reduction AI-powered systems dramatically reduce human error in categorization, calculations, and reporting.

Strategic Clarity Understanding unit economics, burn efficiency, and growth levers transforms how you run your business.

Making the Decision: Signs You're Ready for Modern Financial Operations

You're ready to upgrade if:

- You're spending more than 5 hours monthly on financial tasks

- Your bookkeeper costs exceed $500/month

- You lack real-time visibility into key metrics

- Investor requests create fire drills

- You're using multiple disconnected tools

- Financial management feels like a necessary evil rather than a strategic advantage

The Future of SaaS Financial Operations

The gap between companies using modern AI-powered platforms and those stuck with traditional approaches will only widen. As AI capabilities expand, expect:

- Predictive insights that warn of cash crunches before they happen

- Automated compliance handling tax filings and regulatory requirements

- Strategic recommendations based on patterns from thousands of similar companies

- Natural language queries replacing complex report building

Early adopters of AI-powered financial operations gain competitive advantages that compound over time. They make better decisions faster, operate more efficiently, and scale more confidently.

Conclusion: Your Financial Operations Transformation

The choice isn't between bookkeepers and software, it's between yesterday's fragmented, expensive, slow approach and tomorrow's unified, intelligent, real-time platform.

Modern SaaS companies need modern financial operations. AI-powered platforms deliver the accuracy of experienced bookkeepers, the automation of software, and the intelligence neither traditionally provides all at a fraction of the cost.

Stop accepting the false choice between expensive humans and dumb software. The future of SaaS financial operations is here, and it's intelligent, unified, and built specifically for founders like you.

For a practical, stage-by-stage walkthrough of setting up your financial operations correctly, see our complete guide to bookkeeping for startups.

How Futureproof Empowers SaaS Founders

Futureproof represents the next evolution in financial operations, an AI-powered platform designed by a SaaS founder who experienced these exact pain points. Unlike traditional bookkeepers who don't understand SaaS or generic software that requires constant manual work, Futureproof combines intelligent automation with deep SaaS expertise.

For just $100/month, you get AI-powered bookkeeping that learns your business patterns, automatically categorizes transactions, and maintains accuracy that rivals experienced bookkeepers. Need more? The $200/month AI CFO tier adds sophisticated forecasting, cap table modeling, and scenario planning, capabilities that would cost $5,000+ monthly with traditional fractional CFOs. Your entire financial operation from daily bookkeeping to board reporting unified in one intelligent platform that scales with you from pre-seed and beyond.

Want to see what modern financial operations look like in practice? Start with our free pro forma income statement generator to build investor-ready projections in minutes, not weeks.

Ready to experience financial operations built for modern SaaS?

Start your free trial and see why leading SaaS founders are abandoning spreadsheets and bookkeepers for AI-powered financial intelligence. Transform your financial operations in minutes, not months.