Startup bookkeeping is broken

Traditional bookkeeping wasn't built for startups. You need accuracy, speed, and clarity — not complexity.

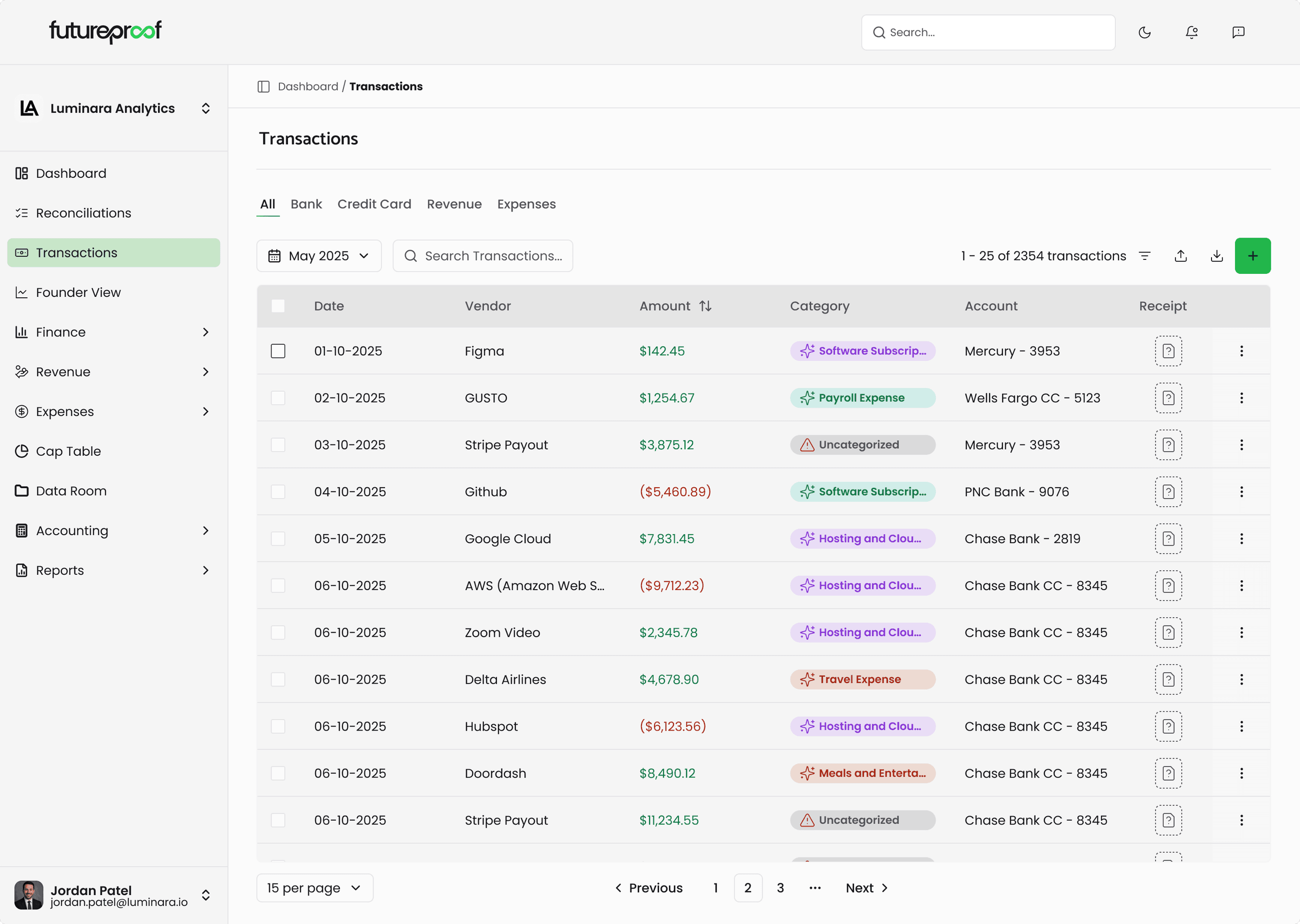

Books Are Always Behind

Your P&L is weeks or months behind. Categorizing transactions manually is tedious and error-prone. You never have a clear picture of where your money is going.

Bookkeepers Are Expensive

Quality bookkeeping services cost $500–$1,000/month. QuickBooks is built for accountants, not founders. You need clean books without the enterprise overhead.

Investors Need Clean Numbers

When investors ask for financials, you scramble to reconcile accounts. Messy books signal disorganization and erode trust before you even start the conversation.

What if your books could manage themselves?

The old way

“Where did that $4,200 charge come from?”

“Our books are 3 months behind again.”

“The investor wants financials by Friday...”

The Futureproof Way

“Every transaction is categorized automatically.”

“Our books are always up to date.”

“Financials are ready to share anytime.”

Bookkeeping that runs itself

AI-powered categorization, real-time statements, and bank-grade security — all on autopilot.

AI-Powered Categorization

Every transaction automatically categorized using models trained on thousands of startup transactions. Revenue, payroll, SaaS, infrastructure — all handled.

Bank-Grade Security

Plaid integration with bank-grade encryption. Read-only access to your accounts. Your data is always secure and private.

Audit-Ready Statements

Real-time P&L, balance sheet, and cash flow statements generated automatically. Always ready when investors or accountants ask.

Continuous Sync

Transactions sync daily from all connected accounts. Your books are always current — not weeks behind like traditional bookkeeping.

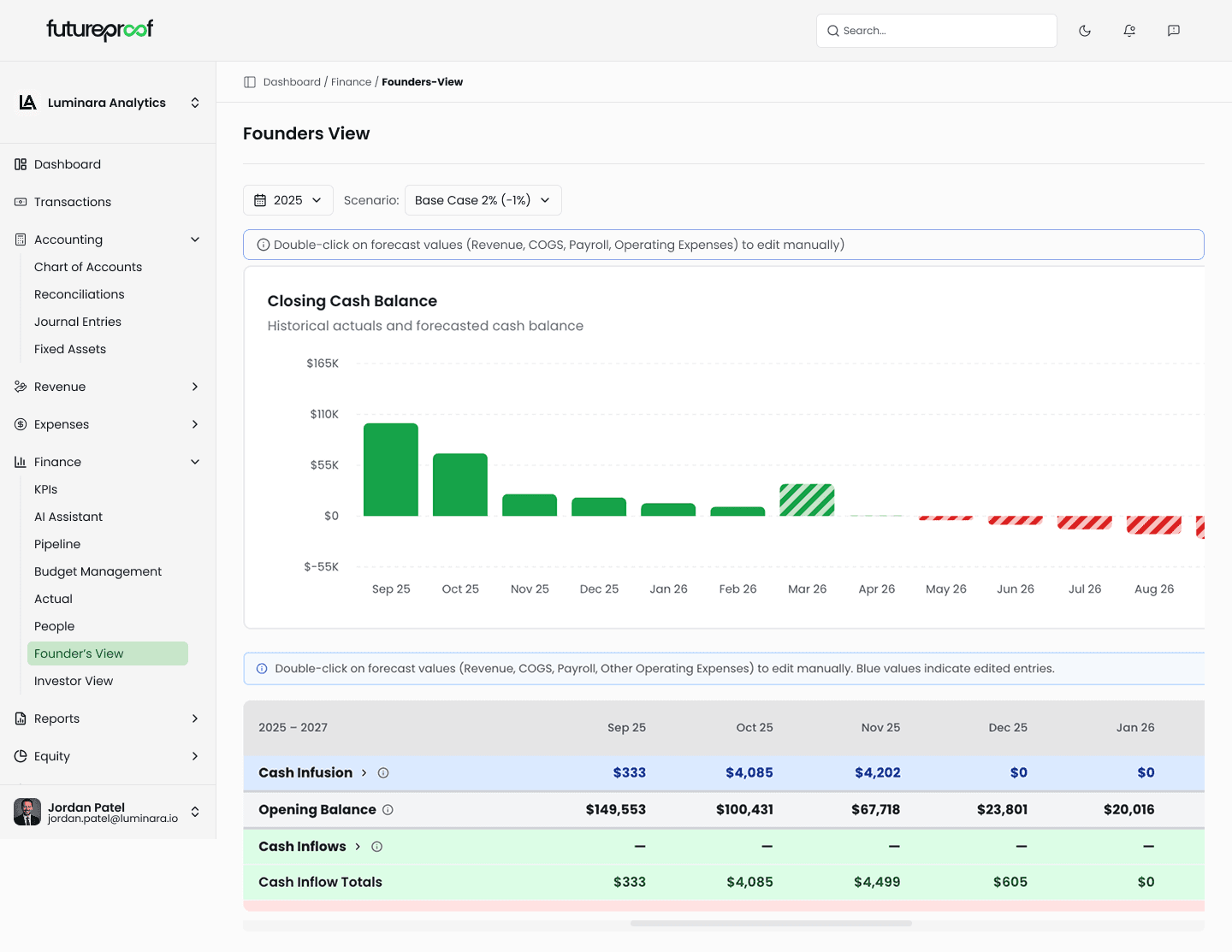

Your real-time financial command center

Founder's View shows your opening balance every month plus real-time cash inflows and outflows — no more managing actuals on spreadsheets. With the forecasting module, see how it all plays out in the future and know exactly when your drop-dead date is.

- Opening balance plus real-time cash in and out each month

- Replace spreadsheet actuals with live, always-current data

- See forecasted future months with the Finance module

- Monthly revenue metrics month over month with Revenue Metrics

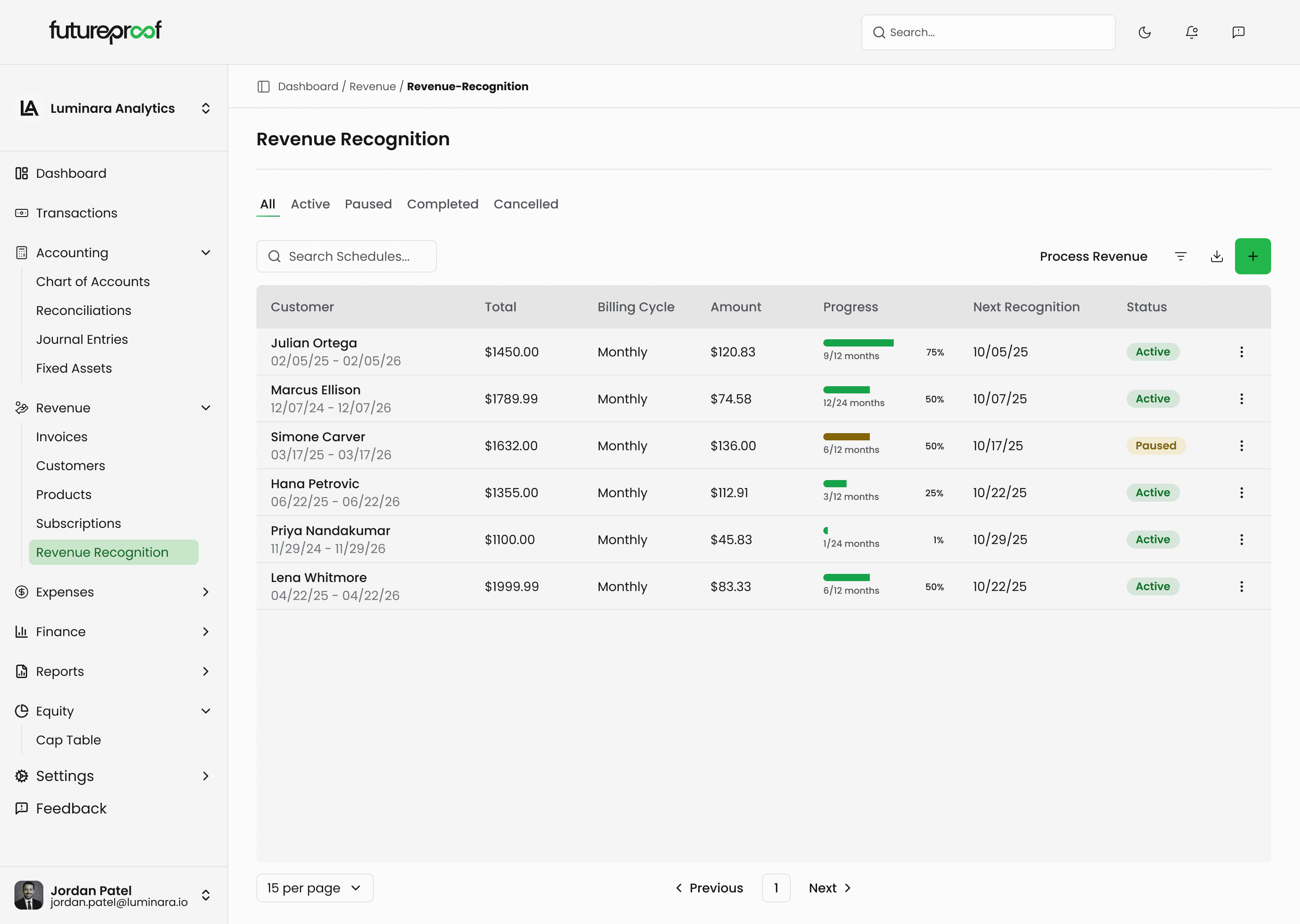

Automatic revenue recognition, built in

Stop manually tracking deferred revenue in spreadsheets. Futureproof automatically creates recognition schedules for every customer — monthly, annual, or custom billing cycles — so your books always reflect the revenue you've actually earned.

- Automatic schedules created for any subscription longer than one month

- Synced to Stripe subscriptions — cancellations and changes reflected automatically

- Track progress per customer with real-time recognition status

- Audit-ready — no more deferred revenue spreadsheets

Set up in minutes, not weeks

No implementation fees. No consulting hours. Just connect and go.

Connect Your Accounts

3 minutesLink your bank accounts, credit cards, and Stripe via Plaid. Secure, read-only access imports your full transaction history.

AI Categorizes Everything

5 minutesOur AI processes your transactions, recognizes vendor patterns, and categorizes each one.

Review Your Clean Books

DoneSee your P&L, balance sheet, and cash flow — all generated automatically. Adjust any categorization and the AI learns from your corrections.

How Futureproof compares

Purpose-built bookkeeping for startups — not a generic tool repurposed for founders.

| Feature | QuickBooks/Xero | Bookkeeper | Futureproof |

|---|---|---|---|

| Setup Time | Days–Weeks | 1–2 Weeks | 5 minutes |

| Monthly Cost | $30–$200/mo | $1.5K–$3K/mo | From $200/mo |

| Real-Time Data | Manual sync | Monthly | Daily auto-sync |

| AI Categorization | |||

| Startup-Optimized | |||

| Investor Reports |

Setup Time

Monthly Cost

Real-Time Data

AI Categorization

Startup-Optimized

Investor Reports