Know Your Numbers Cold — Before Investors Ask.

Track the SaaS metrics that matter: MRR, ARR, churn, LTV, CAC, and net revenue retention. Futureproof pulls directly from your billing data so every metric is accurate, real-time, and investor-ready.

Layered on top of Futureproof Bookkeeping — your financial foundation.

14-day free trial · No credit card required · Cancel anytime

MRR

$47.5k

+15%ARR

$570k

+22%Net Revenue Retention

112%

+3%Churn Rate

2.1%

-0.4%Your revenue metrics shouldn't require a spreadsheet wizard

Manual metric tracking is slow, error-prone, and never matches what Stripe says.

Metrics Live in Spreadsheets

You’re manually calculating MRR from Stripe exports. Formulas break when customers upgrade or churn. Your ARR number is always slightly wrong.

Investors Ask, You Scramble

When a VC asks about net revenue retention or cohort analysis, you spend hours pulling data. The numbers don’t match between your spreadsheet and Stripe.

No Single Source of Truth

ChartMogul shows one MRR number. Your spreadsheet shows another. Stripe shows a third. You never know which one to trust when presenting to investors.

What if your metrics were always right?

The old way

“Which MRR number do I trust?”

“The Stripe export doesn’t match our spreadsheet.”

“I need hours to pull cohort data for the VC.”

The Futureproof Way

“One source of truth for all metrics.”

“MRR, ARR, and churn update in real-time.”

“Investor-ready metrics at a glance.”

Every metric you need, calculated automatically

Real-time SaaS metrics from your actual billing data — no manual calculations required.

Automatic MRR & ARR

Real-time MRR and ARR calculated directly from your billing data. Handles upgrades, downgrades, expansions, and churn automatically.

Churn & Retention Analysis

Track gross and net churn, net revenue retention, and logo retention. See exactly which customers are expanding and which are at risk.

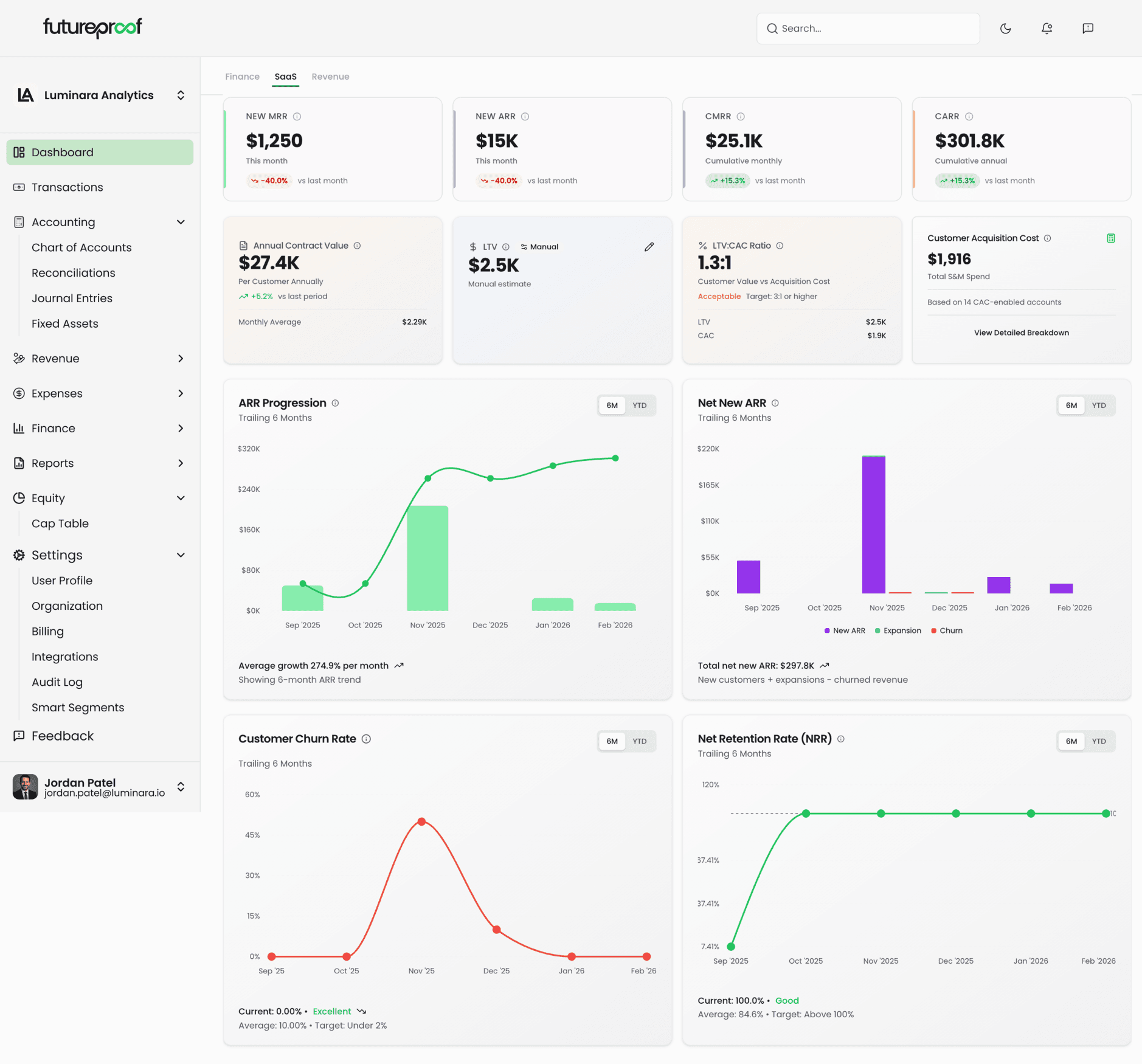

Every SaaS metric, one dashboard

MRR, ARR, churn rate, net retention, LTV:CAC ratio, cohort analysis, and ARR progression — all calculated automatically from your billing data and displayed in a single, real-time dashboard.

- MRR, ARR, CMRR, and CARR at a glance

- Customer churn rate and net retention (NRR) trends

- ARR progression and net new ARR breakdown

- LTV, CAC, and LTV:CAC ratio with benchmarks

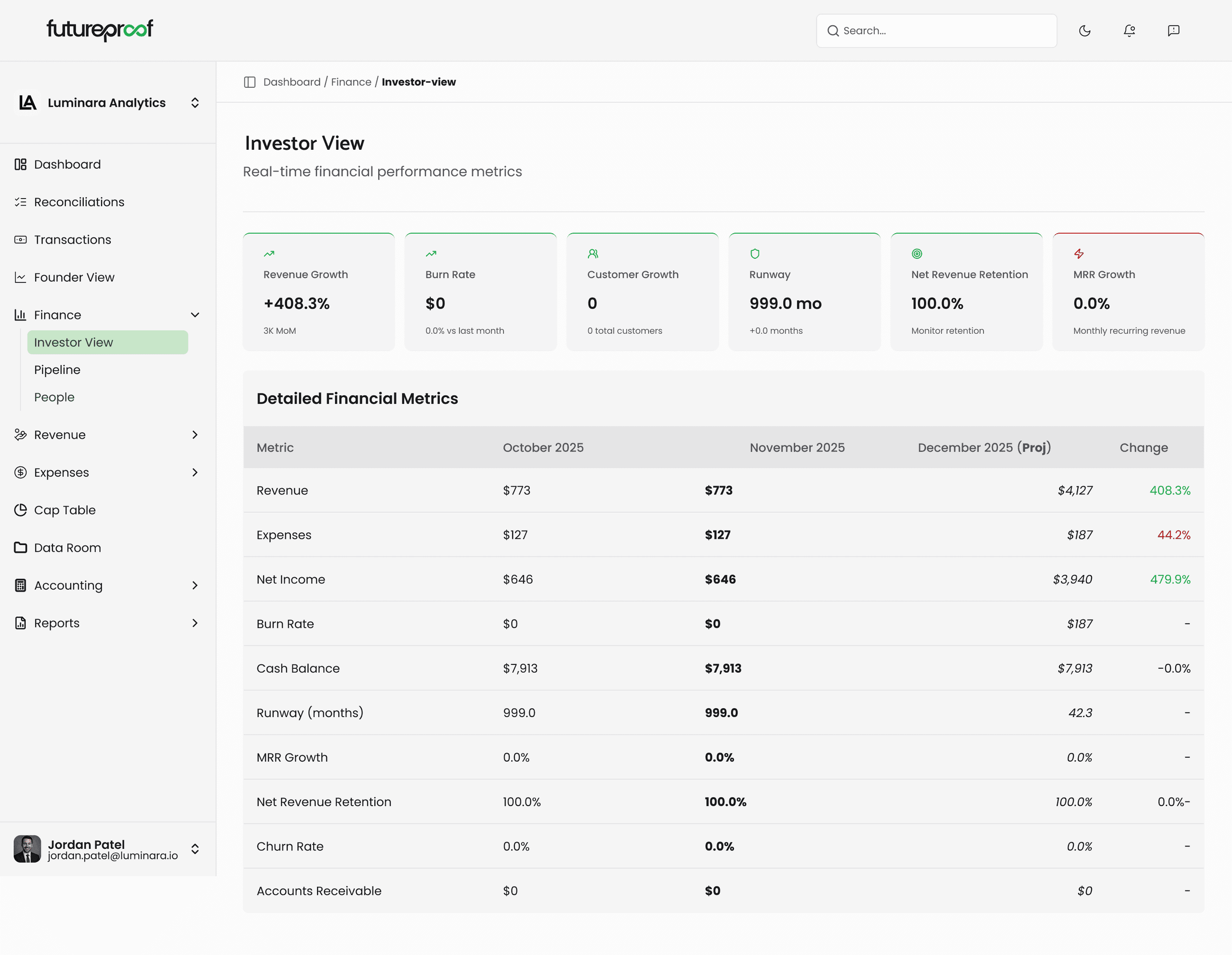

Investor updates, prepared in seconds

Investor View brings together your key financial metrics — historical and current — into a single, presentation-ready dashboard. AI analysis explains the story behind the numbers so you can walk into any monthly or quarterly update with confidence.

- Historical vs. current metrics at a glance

- AI-powered narrative explaining trends and changes

- Ready to share with investors in one click

- Covers MRR, ARR, churn, NRR, and more

From connected to metrics in minutes

Connect Your Billing

3 minutesLink Stripe, your bank, or other billing sources. We import your full revenue history automatically.

Metrics Calculated Instantly

InstantFutureproof processes your billing data and calculates MRR, ARR, churn, NRR, and cohort metrics from day one.

Track & Share

DoneMonitor metrics in real time. Export investor-ready reports.

How Futureproof compares

| Feature | ChartMogul | Spreadsheets | Futureproof |

|---|---|---|---|

| Setup Time | Hours | Days | 3 minutes |

| Data Accuracy | Good | Error-prone | Real-time |

| MRR / ARR Tracking | Manual | ||

| Churn & NRR Analysis | |||

| AI-Powered Insights | |||

| Investor View | |||

| Integrated w/ Books |

Setup Time

Data Accuracy

MRR / ARR Tracking

Churn & NRR Analysis

AI-Powered Insights

Investor View

Integrated w/ Books