Ever chased revenue like it was the answer to everything only to feel more broke the more you grew?

You're not alone.

Founders are taught to glorify RevOps. Get more leads. Build a sales machine. Scale MRR. Sounds sexy, right? But here's the truth:

Revenue is just noise if your finances are chaos.

If you're a SaaS founder trying to scale, FinOps isn't just important, it's your secret weapon. Ignore it, and you'll end up as another "high-growth, no-profit" cautionary tale. Embrace it, and you build something durable, scalable, and fundable.

Let's break this down founder-to-founder.

What Is RevOps (and Why Everyone's Obsessed With It)?

RevOps (Revenue Operations) is about aligning sales, marketing, and customer success to drive predictable revenue. It's the growth engine. It tracks funnels, conversion rates, churn, upsells. Super useful.

But here's where it misleads founders:

You can have dialed-in RevOps and still run out of cash. You can hit $100K MRR and be one payroll cycle away from collapse. You can raise capital and burn it all because you scaled dysfunction.

Growth is great. But growth without financial clarity is a trap.

So What's FinOps (and Why You Can't Ignore It)?

FinOps (Financial Operations) is the system behind the system.

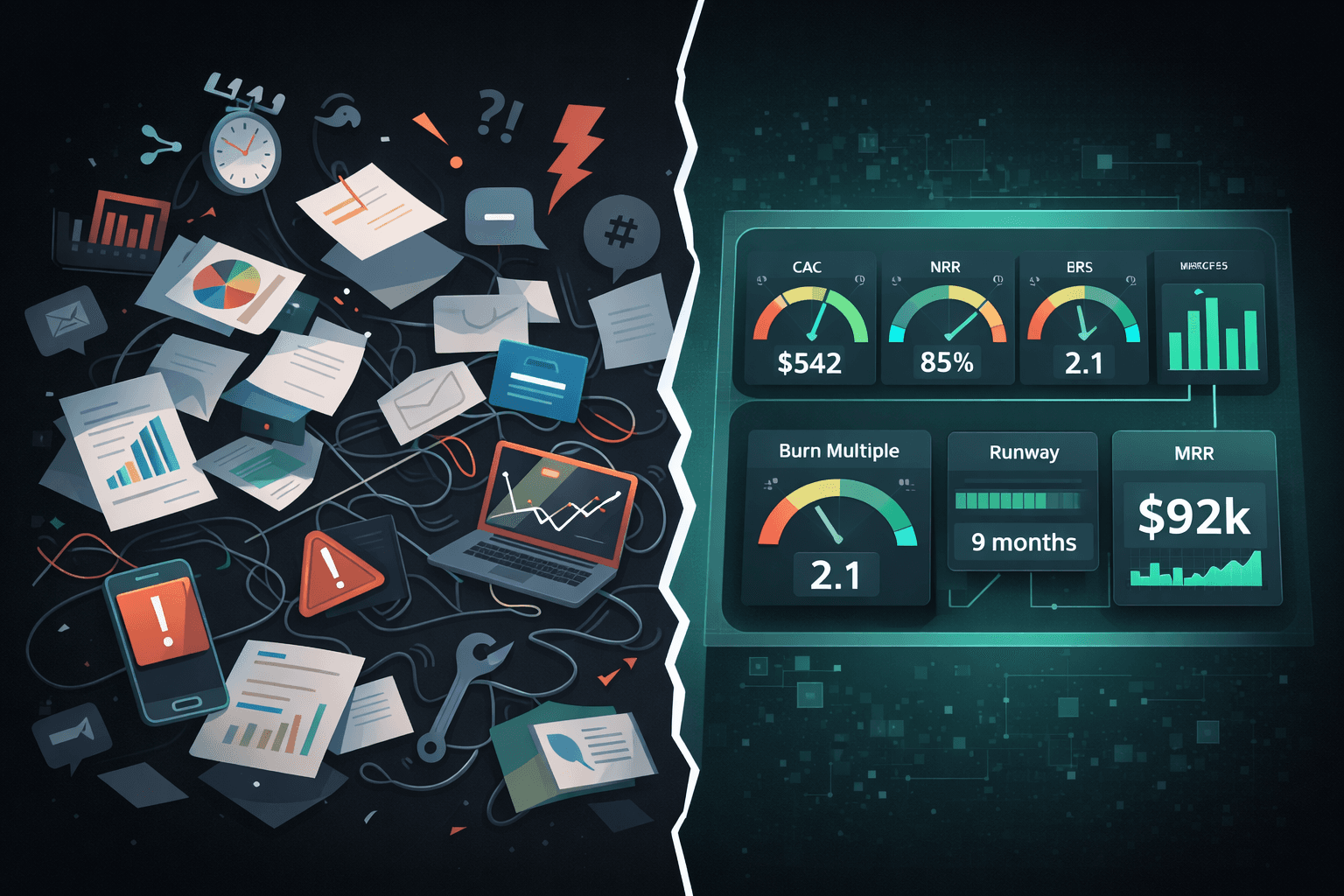

It's not just bookkeeping. It's the cockpit dashboard that tells you:

How much cash you actually have.

How fast you're burning it.

When you'll run out.

What levers give you breathing room or kill you.

FinOps is the layer that makes growth sustainable. It tells the real story behind your metrics. It aligns product, hiring, and sales with actual business health.

If RevOps is the gas pedal, FinOps is the GPS.

Because what good is going fast if you're driving blind?

3 Reasons FinOps Matters More (Right Now)

1. Cash Is King, and Runway Is Your Lifeline

You don't die from lack of revenue. You die from lack of cash.

Founders often confuse booked revenue with bank balance. Big mistake. You can close deals, recognize revenue, and still be broke because:

The cash hasn't landed.

Expenses are growing faster than receipts.

You're paying sales commissions on uncollected invoices.

FinOps helps you see the cash conversion cycle clearly so you don't scale into bankruptcy.

2. Investors Care About Financial Rigor, Not Just Revenue Hype

Early-stage investors don't just want to know how fast you're growing; they want to know:

Can you manage capital efficiently?

Do you understand your unit economics?

Are you making strategic tradeoffs, or just guessing?

Good FinOps makes you more fundable. It shows maturity, discipline, and command of your business.

Your RevOps tells a good story. Your FinOps tells the truth.

3. FinOps Makes RevOps Work Better

Most growth problems are actually financial ones in disguise:

High churn? Maybe you're not delivering enough value per CAC dollar.

Long sales cycles? Maybe you're selling to the wrong segment, burning too much cash per close.

Hiring bottlenecks? Maybe your opex is bloated and eating your margin.

With FinOps, you get x-ray vision into what RevOps is hiding.

You start making surgical decisions instead of emotional ones.

Founder Tip: Flip the Funnel

Everyone talks about top-of-funnel growth.

But founders who last flip the funnel and ask:

What's falling through the bottom?

Where are we leaking money?

Where does growth turn toxic?

FinOps is how you plug those leaks before pouring more water in.

Because revenue without retention is a vanity game. And scaling dysfunction just means you crash faster.

The Myth of the Finance Hire "Later"

Most SaaS founders think: "I'll hire a CFO when we're bigger."

That's like saying, "I'll install a speedometer after we hit the highway."

You don't need a CFO, but you do need financial visibility. You don't need fancy dashboards, but you do need real numbers. You don't need to be an accountant, but you do need to know your runway, burn, and margin. For founders who want CFO-level insights without the full-time hire, our guide on fractional CFO services for startups breaks down when and how to get the support you need.

Start simple. Track your core financial levers. Use tools built for founders, not finance teams (yes, that's what we're building at Futureproof). But do something.

Action Steps: From Blind Spots to Financial Clarity

1. Calculate Burn and Runway Weekly

Know your monthly spend and how many months of cash you've got left. No guesswork.

2. Know Your CAC Payback and LTV

Every dollar spent to acquire a customer should come back fast. Otherwise, you're playing the wrong game.

3. Stop Making Gut Decisions

Track your metrics. Build scenarios. Forecast. Even back-of-napkin projections are better than flying blind.

4. Start a "What If" Habit

What if churn spikes? What if you delay hiring? What if you raise prices? Scenario planning makes you a proactive founder not a reactive one.

Final Thought: Build the Engine Before You Hit the Gas

Growth is only sexy when it's sustainable.

RevOps will get you to $1M ARR.

FinOps will help you keep it and multiply it.

If you're a founder scaling a SaaS company, the real flex isn't your growth rate, it's how long you can stay alive, how efficiently you deploy capital, and how confidently you make hard decisions.

Want to win this game? Start with FinOps!

If you're serious about scaling your SaaS startup without flying blind, it's time to make FinOps your foundation. Futureproof was built for founders like you—no finance jargon, no spreadsheets, just real-time clarity on the numbers that matter. Sign up for a free trial and see how it feels to finally drive with a dashboard.