Your bank isn't just where you park cash. It's the silent partner in every payroll run, every vendor payment, and every investor wire. Choose wrong and you're fighting fires instead of building product. Choose right and your financial operations become invisible, exactly as they should be.

After the 2023 banking crisis that took down Silicon Valley Bank and First Republic, the startup banking landscape fundamentally shifted. Founders are now rightfully paranoid about where they keep their capital, and the options have never been better. Whether you're bootstrapped and watching every dollar or flush with Series A capital, here's your playbook for picking the right banking partner. For a comprehensive framework on managing your cash position and understanding these critical financial metrics, see our guide on runway, burn rate, and cash flow clarity.

Digital vs. Traditional: The Real Trade-Off

Before diving into specific banks, let's address the elephant in the room. Digital-first fintechs like Mercury and Brex offer beautiful interfaces, instant account opening, and integrations that make your bookkeeper's life easier. Traditional banks like J.P. Morgan offer something different: relationship managers who pick up the phone, branch access if you need it, and the psychological comfort of "too big to fail."

The truth? Most well-funded startups need both.

Your operating account lives at a digital bank for daily transactions. Your "escape hatch" account sits at a major institution with 3 to 6 months of runway, ready if something goes sideways. This isn't paranoia. It's pattern recognition from March 2023.

The 5 Banks That Matter

1. Mercury: The Default Choice for Seed-Stage Founders

Mercury has become the de facto standard for early-stage startups, and for good reason. Nearly 40% of new startups choose Mercury, including over half of Y Combinator companies. The interface is clean, account opening takes minutes, and everything just works.

What You Get:

- Free checking and savings accounts with no minimums or monthly fees

- Free domestic and international wires (a rarity that saves real money)

- Up to $5 million in FDIC insurance through sweep networks

- Treasury management with yields reaching the mid-4% range on larger balances

- Venture debt for qualifying VC-backed companies

- Working capital loans for ecommerce businesses

The Venture Debt Angle:

Mercury launched venture debt in 2022, offering term loans up to 48 months for startups that have raised $2M+ from institutional investors. The process is notably simpler than traditional lenders. You'll upload the same documents from your recent VC round and get a decision within weeks, not months. Mercury takes a small warrant position (typically 1 to 2% dilution if exercised) in exchange for competitive interest rates.

Who It's For:

Pre-seed through Series A founders who want frictionless operations. Bootstrapped founders who need zero-fee banking. Ecommerce operators who want integrated payment processor deposits from Stripe, PayPal, and Square.

What to Watch:

Mercury is a fintech, not a chartered bank. Your deposits sit with partner banks (Choice Financial Group, Column, and previously Evolve Bank & Trust). That's fine, but know what you're signing up for. Also, there's no cash deposit capability and customer support is primarily email-based.

2. Brex: The Spend Management Powerhouse for Funded Startups

Brex started with corporate cards and evolved into a full financial stack. Today, 1 in 3 venture-backed startups in the U.S. use Brex. If your company moves fast and you need sophisticated spend controls without adding headcount, Brex delivers.

What You Get:

- Checking account through Column N.A. with no transaction fees

- Treasury account earning up to 3.79% with same-hour liquidity

- Vault accounts spreading deposits across 20+ banks for up to $6 million FDIC coverage

- Corporate cards with no personal guarantee and credit limits based on cash balance

- Automated expense categorization, receipt capture, and GL coding

- Bill pay, invoicing, and travel booking in one platform

- Over $350,000 in startup perks from partners like AWS, OpenAI, and Slack

The Treasury Difference:

Brex's direct relationship with Dreyfus at BNY Mellon means you get the fund's fee back, something most competitors don't offer. Your money sits in government money market funds (the safest asset class short of Treasuries) with same-hour liquidity. No minimum balance requirements, no waiting periods.

Who It's For:

Series A and beyond companies that need enterprise-grade spend management. Founders who want corporate cards without putting their house on the line. Finance teams that want accounting automation without hiring more people.

What to Watch:

Brex has specific eligibility requirements. You generally need to be venture-backed or meet certain revenue thresholds. The platform is overkill for pre-revenue startups. And like Mercury, there's no cash deposit capability.

3. Silicon Valley Bank (SVB): The Veteran That's Still Standing

Yes, that SVB. After the FDIC takeover and acquisition by First Citizens Bank, SVB is back and still serves 60% of the 2024 Forbes Fintech 50. The relationships, sector expertise, and venture debt capabilities remain.

What You Get:

- Full-service banking with dedicated relationship managers

- Venture debt from the industry's most experienced team (40+ years in the innovation economy)

- Foreign exchange in 90+ currencies across 110+ countries

- Corporate cards with venture-friendly underwriting

- Proprietary research and benchmarking data across sectors

- Access to investor networks and industry events

The Venture Debt Originator:

SVB invented venture debt. Their Strategic Capital Group recently partnered with Pinegrove Venture Partners to deploy $2.5 billion in venture debt loans. Typical structures include 20 to 40% of your last equity round, 24 to 48 month terms, and warrant coverage in the 5 to 20% range of the loan value.

The key insight: raise venture debt from a position of strength (right after an equity round), not when you're desperate. SVB's underwriting focuses on the quality of your VC backers and founding team, not your current revenue.

Who It's For:

Series A through pre-IPO companies that want relationship banking with sector expertise. Founders who value introductions to investors and corporates. Companies that need global banking capabilities.

What to Watch:

The 2023 collapse shook confidence, and many founders now maintain SVB alongside a second institution. The onboarding process is more involved than fintechs, and you won't get the slick interface you're used to from Mercury or Brex.

4. J.P. Morgan Chase: The "Too Big to Fail" Safety Net

When SVB collapsed, founders flooded into J.P. Morgan. The bank's startup client portfolio nearly doubled in 2023, and they've added 200+ bankers to their innovation economy division. Chase offers something the fintechs can't: the psychological comfort of a $4 trillion institution.

What You Get:

- Dedicated startup banking division with former founders and VC operators

- Chase Connect for real-time cash management and reporting

- No fees for up to three years on included services

- Wire transfers in nearly 70 currencies

- Automated invoicing through Cashflow 360 (powered by Bill.com)

- J.P. Morgan Workplace Solutions for cap table and equity compensation management

- Curated startup offers from ecosystem partners

The Traditional Banking Advantage:

Chase provides what digital banks can't: branches, relationship managers who understand startup economics, and a balance sheet that regulators will never let fail. Their treasury management teams can allocate your cash into money market funds, Treasury bills, and insured sweep accounts.

Who It's For:

Any founder who wants a "safety" account alongside their primary digital bank. Series B+ companies with complex treasury needs. Founders who value in-person relationships and dedicated banker support.

What to Watch:

The interface and UX lag behind the fintechs. Account opening requires more documentation and often an introduction to the technology coverage team (don't just walk into a branch). And while fees are waived initially, standard pricing kicks in after three years.

5. Relay: The Bootstrapped Founder's Dream

If you're building a profitable business without VC backing, Relay offers the best combination of zero fees, multiple accounts, and cash flow management tools. It's not trying to be Mercury for venture-backed companies. It's trying to be the perfect bank for everyone else.

What You Get:

- Truly free checking with no monthly fees, minimums, or overdraft fees

- Up to 20 separate checking accounts for profit-first cash management

- Up to 50 debit cards (physical or virtual) with spending limits

- Free incoming wire transfers; domestic outgoing wires at $8

- Direct integrations with QuickBooks Online, Xero, and Gusto

- Savings accounts with up to $2.5 million FDIC coverage through insured cash sweep

- Built-in expense categorization and receipt capture

The Profit-First Approach:

Relay's multi-account structure was built for the "Profit First" methodology. Create separate accounts for operating expenses, taxes, payroll, and owner distributions. Each account has its own routing and account numbers, making automated transfers and expense tracking simple.

Who It's For:

Bootstrapped founders who want to maximize every dollar. Agencies and service businesses with tight margins. Ecommerce operators who don't need venture debt but want solid banking infrastructure. Accountants managing multiple client accounts.

What to Watch:

Relay partners with Thread Bank (which received an FDIC enforcement action in 2024, though customer funds remain safe). There's no venture debt or credit card offering. And the Pro plan ($30/month) is needed for same-day ACH and advanced bill pay features.

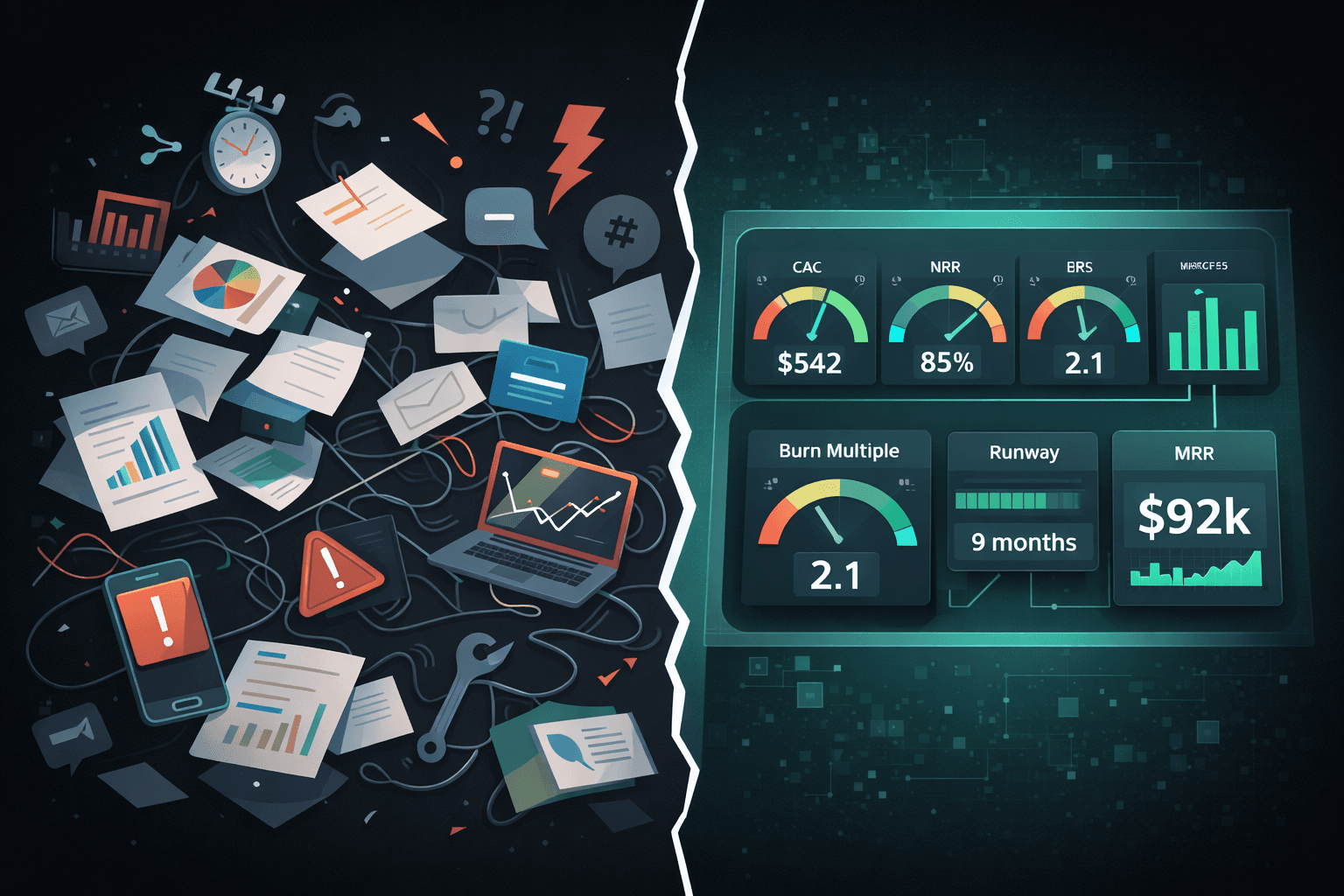

Treasury Management: Where Your Cash Should Actually Sit

If you've raised venture capital, you have a fiduciary duty to protect those funds. Standard FDIC coverage is $250,000, which is nothing for a company with $5 million in the bank. Here's how to think about treasury:

Insured Cash Sweep (ICS) Accounts:

Services like IntraFi Network distribute your funds across multiple FDIC-insured banks in $250,000 increments. Your primary bank manages the distribution while providing consolidated reporting. Most startup banks now offer this, with coverage limits reaching $5 to $75 million depending on the provider.

Money Market Funds:

Not FDIC-insured, but invested in government securities backed by the full faith and credit of the U.S. Treasury. Brex, Mercury, and Rho all offer these. Yields currently sit in the 3.5 to 4.5% range, and liquidity is typically same-day or same-hour.

Direct Treasury Bills:

For funds exceeding sweep limits, consider Treasury bills directly. They're the lowest-risk investment available and can be purchased through your bank's treasury team or TreasuryDirect.gov.

The VC Term Sheet Reality:

Increasingly, term sheets include treasury clauses requiring founders to maintain an investment policy statement (IPS) or use multiple banking relationships. Your investors don't want their capital sitting uninsured at a single institution. Build your banking stack accordingly.

Venture Debt Decoded: When (and How) to Use It

Venture debt isn't dilutive equity. It's also not free money. Here's what you need to know:

What It Is:

A term loan for VC-backed companies, typically structured with interest-only payments, a bullet repayment at maturity, and warrant coverage giving the lender the right to purchase equity.

Typical Terms:

- Loan size: 20 to 40% of your last equity round or 6 to 8% of post-money valuation

- Interest rate: Prime + 2 to 6% (currently 9 to 12% all-in)

- Repayment: 24 to 48 months

- Warrant coverage: 5 to 20% of loan value (translating to roughly 1 to 2% equity dilution if exercised)

- Covenants: Minimum revenue targets, debt-to-equity ratios, negative pledge on IP

When to Use It:

Raise venture debt immediately after closing an equity round, when you have maximum leverage. Use it to extend runway 3 to 9 months without additional dilution. Fund specific projects like equipment purchases or market expansion. Bridge to profitability and eliminate the need for another equity round.

When to Avoid It:

Don't raise venture debt when you're desperate for cash, as lenders will see through it and terms will be punitive. Avoid it if the monthly payments will constrain your growth spending. And never use venture debt as a substitute for equity when your business fundamentally needs more capital.

The Warrant Math:

If you raise $2 million in venture debt with 10% warrant coverage, the lender receives warrants to purchase $200,000 worth of stock at your current share price. If you exit at 10x that valuation, those warrants are worth $2 million to the lender, 100% return on top of the interest they already collected. That's the trade-off for non-dilutive (well, mostly non-dilutive) capital.

ACH Speed: Why Same-Day Transfers Matter

Standard ACH transfers take 1 to 3 business days. Same-day ACH gets money moving within hours. Here's why it matters:

For Payroll:

If your ACH window is 2pm and you submit payroll at 3pm on Thursday, your team doesn't get paid until the following Tuesday. Same-day ACH eliminates that lag.

For Vendor Discounts:

Many vendors offer 2% early payment discounts. If you can pay same-day instead of waiting for standard ACH to clear, you capture those savings.

For Cash Flow Timing:

When a customer's ACH payment arrives matters for your cash position. Same-day or next-day ACH from your processor makes your runway more predictable.

What to Look For:

Mercury offers free domestic wires (which clear same-day) and same-day ACH on certain transactions. Brex provides same-hour liquidity from their treasury accounts. Relay's Pro plan includes same-day ACH. Traditional banks typically charge $25 to $50 for wire transfers, making same-day payments expensive.

Bootstrapped vs. Venture-Backed: Different Needs, Different Banks

If You're Bootstrapped:

Your priorities are zero fees, profitable operations, and building a cash cushion. Relay or Bluevine offer the best combination of free banking and yield on deposits. You probably don't need venture debt (and likely won't qualify anyway). Focus on banks that integrate with your accounting software and make reconciliation painless.

If You're Raising VC:

Your priorities are safety, speed, and access to capital markets. Start with Mercury for operational banking, add J.P. Morgan or Chase as your escape hatch, and explore venture debt from Mercury, SVB, or specialized lenders as you scale. Make sure your sweep accounts can handle your post-raise balance with full FDIC coverage.

If You're Scaling Past Series B:

You need relationship banking, global capabilities, and sophisticated treasury management. SVB or J.P. Morgan become your primary partners. Brex handles your spend management and corporate cards. You're probably past the point where Mercury's feature set matters more than human relationships.

The Bottom Line

Your bank should be invisible infrastructure, not a source of friction. Choose Mercury or Relay if you want zero-fee simplicity. Add Brex when you need sophisticated spend controls. Use J.P. Morgan or Chase as your safety net. And explore venture debt from Mercury or SVB when you need to extend runway without dilution.

The banking landscape has never been better for founders. The only mistake is not thinking about it at all.

For a complete guide to setting up your financial operations alongside the right banking infrastructure, see our complete guide to bookkeeping for startups.

Building a SaaS or ecommerce company and want to understand your financial metrics better? Explore our financial glossary for founder-friendly definitions of everything from MRR to runway to dilution.