I've watched hundreds of founders do it. The email from their bookkeeper sits unopened. The QuickBooks login collects digital dust. The Stripe dashboard gets a nervous glance before quickly clicking away. They're building something extraordinary—closing deals, shipping features, leading teams—but when it comes to their own financial reality, they go dark.

It's not laziness. It's not ignorance. It's financial anxiety founders rarely talk about but almost everyone feels.

After 25 years across six startups and mentoring thousands of founders, I've seen this pattern destroy businesses that should have thrived. The cruel irony? The very act of avoiding your financials creates the chaos you're afraid to face. But here's the thing: once you understand why you're avoiding, you can break the pattern. And breaking it changes everything.

The Invisible Weight You're Carrying

Financial avoidance doesn't announce itself with fanfare. It creeps in quietly, disguised as prioritization.

"I'll look at the books next week when things calm down."

"I need to focus on revenue first, then I'll deal with the backend."

"My co-founder handles that stuff."

Sound familiar? These aren't excuses—they're survival mechanisms. Your brain is protecting you from what it perceives as threat. And in the founder's world, few things feel more threatening than opening a spreadsheet that might confirm your worst fears.

The numbers might show you're burning faster than you thought. That your runway is shorter. That the metrics investors care about aren't where they need to be. So you avoid them. Not because you're weak, but because you're human.

Here's what I've learned from working with founders at every stage: financial anxiety isn't about the numbers themselves. It's about what the numbers represent—judgment, failure, the gap between where you are and where you promised investors (or yourself) you'd be.

The Three Psychological Patterns That Keep You Stuck

Pattern 1: The Schrodinger's Startup Effect

As long as you don't look at the numbers, your startup exists in a state of potential success. The moment you open that P&L, you collapse the wave function. Reality becomes fixed.

I worked with a SaaS founder who went four months without reconciling his books. When we finally sat down together, he admitted: "If I don't know how bad it is, I can still believe we're going to make it."

The problem? While he was avoiding reality, his burn rate accelerated, his cash position deteriorated, and he missed the window to course-correct before investors noticed. By the time he faced the numbers, his options had narrowed significantly.

The truth is, not knowing doesn't protect you. It just delays the reckoning while making it worse.

Pattern 2: The Perfectionism Trap

Some founders avoid their financials because they want them to be perfect before they look. They wait for the books to be fully reconciled, for every transaction to be categorized, for the dashboard to show clean data.

This is procrastination dressed in professional clothing.

I remember a founder who spent six weeks building the "perfect" financial model before she'd even look at her actual numbers. When I asked why, she said: "I want to have solutions ready when I see the problems."

But you can't solve problems you won't acknowledge. And you can't build accurate forecasts when you're disconnected from your current reality. Waiting for perfect means staying stuck in the dark.

Pattern 3: The Shame Spiral

This is the deadliest pattern. You miss a month of bookkeeping. Then two. Then six. Now you're so far behind that looking at it feels overwhelming and embarrassing. So you avoid it longer, which makes it worse, which increases the shame.

One e-commerce founder I coached hadn't looked at his financials in eight months. Eight months. When I asked why, he said: "At this point, I'm terrified of what I'll find. And I'm ashamed that I let it get this bad."

The shame spiral is vicious because it feeds on itself. The longer you avoid, the worse you feel. The worse you feel, the harder it is to start. And while you're trapped in the spiral, your business decisions are being made in the dark.

What Financial Avoidance Actually Costs You

Let's get concrete about the price you pay for staying in the dark:

Missed opportunities. You can't optimize what you can't see. That customer segment that's barely profitable? You're spending marketing dollars on them. That expense category that's grown 40% in three months? You don't know it exists. Every day without financial clarity is a day of making decisions with incomplete information.

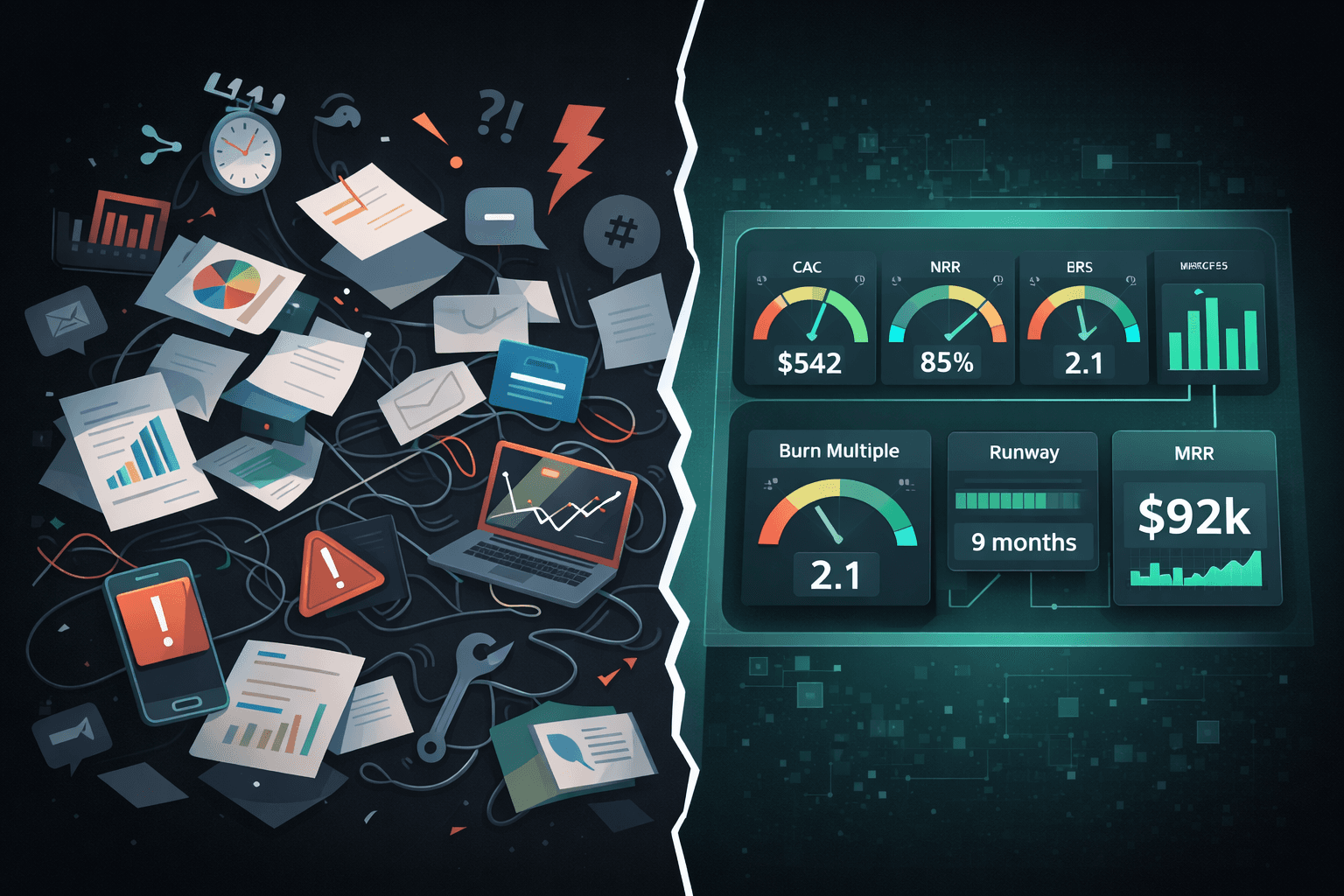

Investor trust. Nothing kills investor confidence faster than a founder who can't speak fluently about their metrics. When you're asked about burn multiple or CAC payback period and you fumble, investors hear: "This person doesn't have control of their business."

Strategic paralysis. Should you hire that engineer? Launch that new feature? Expand to a new market? Without financial clarity, every big decision becomes a coin flip. You're not leading—you're guessing.

Mental bandwidth. Here's what nobody tells you: the anxiety of not knowing is more exhausting than the reality of knowing. Financial avoidance doesn't reduce stress—it creates a constant, low-grade dread that follows you everywhere. It's there when you're trying to focus on product. It's there when you're pitching investors. It's there at 3 AM when you can't sleep.

The Pattern-Breaking Framework

Breaking the avoidance pattern isn't about willpower or discipline. It's about redesigning your relationship with your financials. Here's the framework that's worked for hundreds of founders I've coached:

Step 1: Start With One Number

Don't try to understand everything at once. Pick one metric that matters most right now. For most early-stage founders, that's runway. How many months of cash do you have at your current burn rate?

That's it. Find that one number. Write it down. Sit with it. Once you can look at one number without spiraling, add another.

Step 2: Schedule The Exposure

Put a recurring 30-minute meeting on your calendar called "Financial Reality Check." Every week, same time, just you and your numbers. No judgment, no solutions, just observation.

Look at your bank balance. Review your burn. Check your runway. That's it. You're not fixing anything yet—you're building the habit of looking.

Why does this work? Because repeated exposure reduces anxiety. The numbers stop being scary when you see them regularly. They become data instead of threat.

Step 3: Name The Fear

Before you look at your financials each week, write down what you're afraid you'll find. Be specific:

"I'm afraid I'll see we only have three months of runway."

"I'm afraid the numbers will show I made a terrible decision."

"I'm afraid this will confirm I'm failing."

Then look at the numbers. Compare reality to fear. Nine times out of ten, reality is less catastrophic than the story you told yourself. And on that tenth time when it is bad? At least now you know, and knowing gives you agency.

Step 4: Build A Response Protocol

This is the key most founders miss: you need a predetermined plan for what you'll do when you find something concerning.

If runway drops below six months → trigger conversation with board

If burn increases 20% month-over-month → immediate expense audit

If CAC exceeds LTV → pause paid acquisition and investigate

When you have a protocol, scary numbers become action items instead of existential threats. You shift from "oh no" to "okay, here's what we do next."

Step 5: Get A Witness

Financial avoidance thrives in isolation. Bring someone else in—a co-founder, advisor, or coach. Not to judge, but to witness.

Tell them: "I struggle with looking at my financials. I need accountability." Then review your numbers together weekly. Just knowing someone else will see them makes avoidance harder.

One founder I worked with started sending me a screenshot of his dashboard every Monday morning. No analysis required—just proof he looked. Within two months, the avoidance was gone. Why? Because the pattern was interrupted.

For founders who need more than accountability, fractional CFO support can provide the financial leadership and clarity that breaks the avoidance cycle for good.

The Transformation On The Other Side

Here's what happens when you break the avoidance pattern:

Your decisions get sharper. You start seeing patterns you missed. That product line that seemed promising? The numbers show it's destroying margins. That channel you were skeptical about? It's your most efficient customer acquisition source.

Your confidence grows. Not because the numbers are perfect, but because you're no longer in the dark. Founders who face their financials regularly carry themselves differently. They speak with clarity. They make bold moves because they know the landscape.

Your fundraising improves dramatically. Investors sense when a founder has command of their metrics. They ask harder questions, but you have answers. The conversation shifts from them evaluating you to you demonstrating mastery.

But the biggest shift? The mental bandwidth you reclaim. That constant background anxiety dissolves. You sleep better. You focus harder. You lead more effectively.

Because here's the truth: you can't lead a company you're afraid to look at.

Your Numbers Are Trying To Help You

Financial data isn't your enemy. It's not there to judge you or expose your inadequacy. Your numbers are trying to tell you a story—about what's working, what isn't, and where the opportunities hide.

But you have to be willing to listen.

The founders who scale from seven to eight figures aren't smarter than you. They're not more talented. They're just willing to face reality earlier and more consistently. They've built the muscle of looking when it's uncomfortable. And that muscle—more than brilliant strategy or perfect execution—is what separates businesses that scale from businesses that stall.

Financial avoidance isn't a character flaw. It's a pattern. And patterns can be broken.

Start today. Pick one number. Look at it. Then look again tomorrow. That's how you break the pattern. That's how you build the foundation for everything else.

The easiest first step? Generate a simple financial snapshot. Try our free pro forma income statement generator and see your numbers laid out clearly in under five minutes.

For a practical, stage-by-stage guide to setting up the financial systems that make facing your numbers easier, see our complete guide to bookkeeping for startups.

Futureproof was built for founders who are ready to face their numbers without the overwhelm. We turn financial chaos into clarity—automatically categorizing transactions, tracking the metrics that matter, and helping you see around the corner. If you're ready to break the avoidance pattern for good, book a demo and see how financial clarity changes everything.