The financial operating systemfor growing companies.

AI-powered bookkeeping, revenue metrics, forecasting, and fundraising tools — whether you're a SaaS startup or an ecommerce brand. One platform, no spreadsheets.

$49

per month

10 min

to full setup

95%

AI accuracy

Monthly Revenue

$47,500

Built for How You Grow

Same powerful platform, tailored to your business model.

One Platform. Every Financial Tool You Need.

Start with one module and add more as you grow. Every piece works independently or together.

One Application. Everything You Need.

AI-powered bookkeeping, revenue metrics, and forecasting for SaaS startups and ecommerce brands — in one platform.

AI Powered Bookkeeping

Connects to your bank, Stripe, Amazon, and Shopify — then automatically categorizes every transaction.

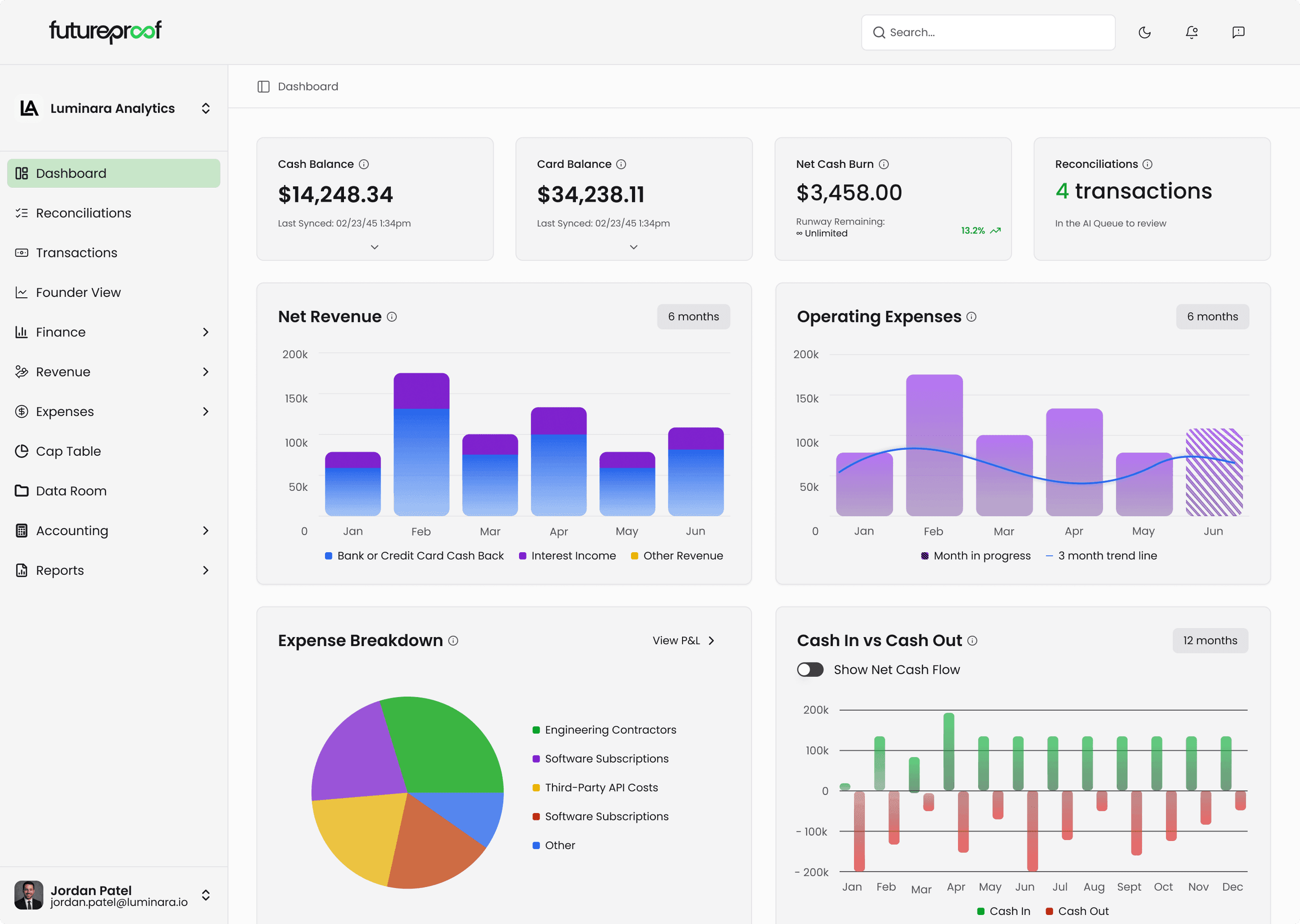

Real-Time Dashboard

Revenue, margins, burn rate, runway, and cash position — all at a glance, updated in real time.

Burn Rate

Runway

Cash

MRR

Smart Categorization

AI trained on SaaS and ecommerce knows subscription tools from marketplace fees and COGS.

Digital Cap Table

Track founder equity, advisor shares, and early SAFEs in one place.

Expense Insights

Understand where every dollar goes with intelligent expense grouping across all channels.

Monthly Reports

Generate clean P&L statements for investors and advisors instantly.

Connect Everything. Secure Everything.

Plug into the tools you already use. Your data stays encrypted end-to-end.

Stripe

Automatic payment reconciliation and revenue tracking across all transactions

Shopify

Sync orders, refunds, and payouts across your Shopify stores automatically

Amazon

Import seller transactions, fees, and payouts from Amazon Seller Central

Plaid

Securely connect bank accounts, credit cards, and financial institutions

HubSpot

Sync CRM data with your financials for complete customer insights

Bunny

Automated billing, quoting, and subscription management for growing businesses

Banks & Credit Cards

Securely sync transactions from any major bank or corporate card, updated daily.

Bank-Level Security

256-bit AES encryption, read-only access, SOC 2 compliant infrastructure. Your financial data never leaves our secure environment.

How Founders Solved Their Finance Chaos

“I was spending hours every month reconciling transactions across multiple tools. Revenue from different channels, expenses scattered everywhere — nothing matched. Futureproof categorized everything automatically and now I actually trust my numbers.”

Alex R.

VerifiedCEO, Growth Stage

“We sell on Shopify and Amazon. Before Futureproof, I had no idea which channel was actually profitable after ad spend and fees. Now I see true margins per channel in real time.”

Rachel T.

VerifiedFounder, DTC Brand

“Connected my accounts and was done in minutes. Books closed, dashboard live, forecast built — all in one place. My board loves the reports and I stopped dreading month-end.”

Sarah M.

VerifiedFounder, Series A