A founder called me three weeks before his Series A close date. The lead investor had asked for updated financials. Simple request. Standard procedure.

But his books were six months behind. His categorization was a mess. His burn rate calculation was off by 40%. The deal didn't just slow down—it died. The investor didn't trust him anymore, and trust, once lost in fundraising, doesn't come back.

That founder had product-market fit. Real revenue growth. Passionate customers. None of it mattered. His startup financial management was so chaotic that investors couldn't underwrite the risk. For founders wondering when professional financial support makes sense, our guide on fractional CFO options for startups breaks down the decision. Two years of building, gone, because of bad books.

This isn't rare. It's not even uncommon. It's the default state for most early-stage startups. And it's destroying businesses that should succeed.

After working with thousands of founders across 25 years and six startups, I can tell you: the cost of financial chaos is higher than you think. It's not just about messy spreadsheets or late filings. It's about the opportunities you miss, the decisions you get wrong, and the credibility you can't rebuild.

The Obvious Costs You Already Know About

Let's start with the visible damage—the stuff you can actually see and measure.

Time Hemorrhage

You spend ten hours a week chasing receipts, reconciling accounts, and trying to make sense of disconnected systems. That's 500 hours a year. If your time as a founder is worth $200/hour (it's probably worth more), that's $100,000 in opportunity cost annually.

But the real cost isn't the hours—it's what you're not doing with those hours. You're not talking to customers. You're not refining product. You're not thinking strategically. You're hunting for a transaction from three months ago that you can't remember and your bookkeeper can't find.

Accounting and Cleanup Costs

When your books are a disaster, you eventually pay someone to fix them. But here's what founders don't realize: cleanup is expensive.

Catching up six months of bookkeeping? $5,000-$15,000.

Untangling misclassified transactions across multiple years? $10,000-$30,000.

Preparing for an audit with incomplete records? $20,000-$50,000+.

And that's just to get back to zero. Not to improve. Not to get ahead. Just to undo the damage.

I worked with a founder who spent $40,000 cleaning up two years of financial chaos because he needed audited financials for an acquisition. The deal was worth $8M. The cleanup bill almost killed it because it revealed inconsistencies the acquirer hadn't anticipated.

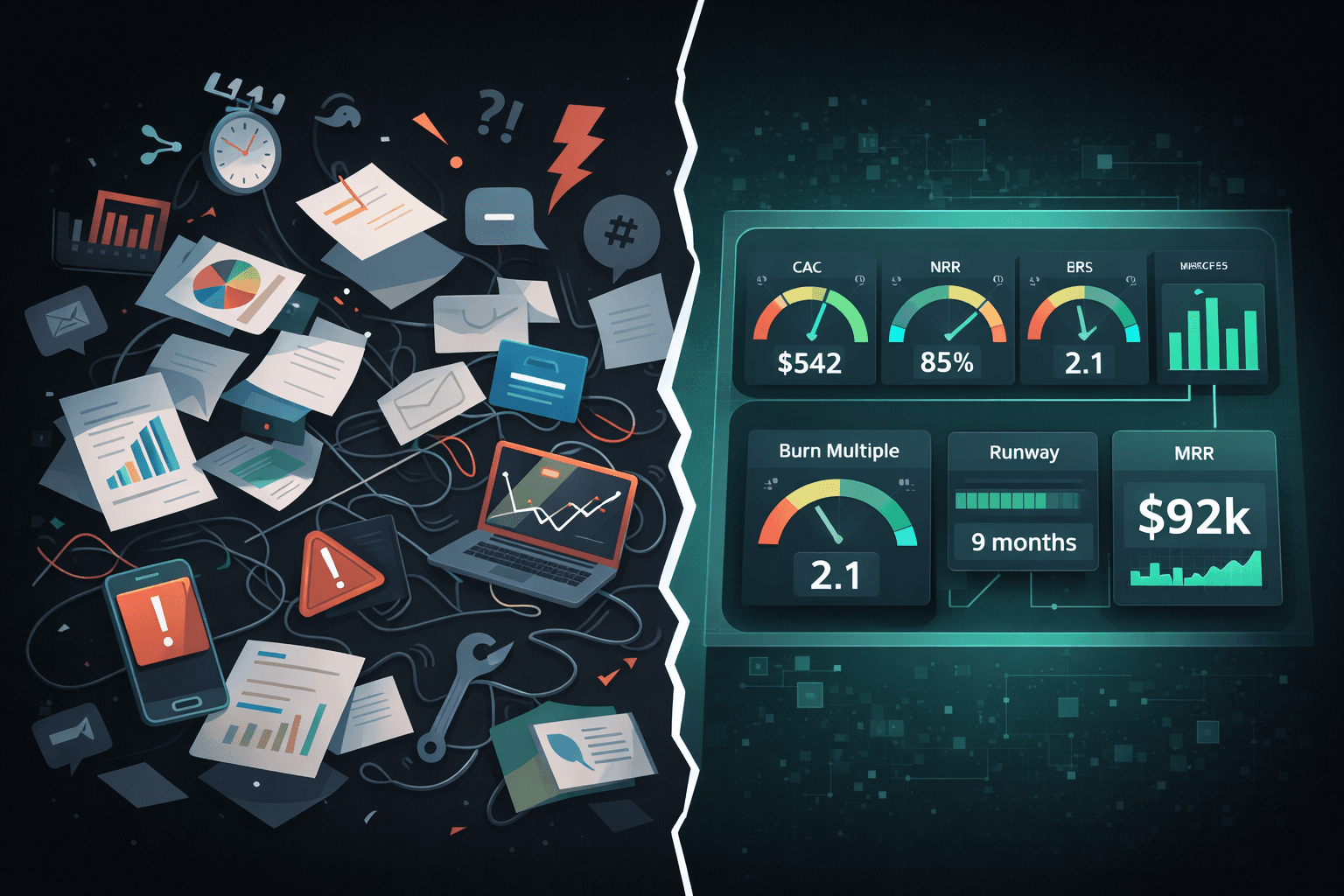

Software Stack Bloat

No single tool does everything, so you cobble together solutions. QuickBooks for bookkeeping. Excel for forecasting. Carta for cap table. Expensify for expenses. Stripe for billing. Notion for documentation.

Each tool costs money. Each tool requires time to learn and maintain. Each tool creates another silo of data that doesn't talk to the others. When you need to project profitability or model growth scenarios, these disconnected systems make it nearly impossible to build a reliable pro forma income statement without hours of manual work.

The average early-stage startup spends $2,000-$5,000 per month on disconnected financial tools, plus another $5,000-$10,000 annually on integrations and consultants to make them work together. You're paying to create complexity.

The Hidden Costs That Actually Kill You

The obvious costs are painful but survivable. The hidden costs are what actually sink startups.

Delayed Decision-Making

How long does it take you to answer these questions:

Which customer segment is most profitable?

What's our real burn rate this month?

How much runway do we have if we hire two engineers?

Which marketing channel has the best ROI?

If it takes more than five minutes, your financial chaos is costing you velocity. Every day you spend gathering data is a day you're not acting on it.

I coached a SaaS founder who discovered—eight months too late—that his enterprise customers had 3x the gross margin of his SMB customers. He'd been pouring marketing dollars into SMB because he thought they were easier to close. They were. But they were also destroying profitability. Eight months of misallocated resources because his books couldn't tell him what was working.

Wrong Strategic Decisions

When you're flying blind, you make decisions based on intuition instead of data. Sometimes you get lucky. Usually, you don't.

You hire too fast because you don't realize burn is accelerating.

You chase revenue in unprofitable segments because you can't calculate unit economics by cohort.

You delay fundraising until it's too late because you don't have real-time runway visibility.

You double down on a channel that feels like it's working but is actually bleeding money.

Financial chaos doesn't just slow you down—it points you in the wrong direction. And in the startup world, wrong direction at high speed is fatal.

Investor Confidence Erosion

This is the killer. This is the cost that ends companies.

Investors don't just invest in traction. They invest in founders who demonstrate control, discipline, and scalability. Your financials are the proof.

When you can't answer basic questions about your metrics, investors hear: "This founder doesn't know their business."

When your numbers don't match across different conversations, investors hear: "This founder can't be trusted."

When your books are messy and delayed, investors hear: "This founder won't scale."

You might have the best product in the world. Doesn't matter. If investors don't trust your financial command, they walk. And they tell other investors. The damage spreads.

I've watched founders lose term sheets not because their metrics were bad, but because their metrics were unreliable. One founder I mentored had three different versions of his ARR depending on which system he pulled from. When the lead investor caught the inconsistency, the deal died in two days.

Employee Morale and Equity Confusion

Your early employees took less cash for equity. But do they actually know what their equity is worth? Can they see their vesting schedule? Do they understand what happens at the next funding round?

Most can't. Because most cap tables are a disaster.

When employees don't understand their equity, they undervalue it. When they undervalue it, they leave. You lose talent not because you didn't compensate them fairly, but because you couldn't communicate what you gave them.

An e-commerce founder I worked with lost his CTO three months before launch because the CTO didn't realize his equity stake had been diluted by a SAFE round six months earlier. The founder hadn't updated the cap table, so nobody knew. Trust shattered. CTO left. Launch delayed by four months.

Regulatory and Compliance Landmines

Messy books don't just hurt fundraising—they create legal exposure.

Misclassified employees vs contractors? IRS penalties can be catastrophic.

Incorrect sales tax collection? You're personally liable in many states.

Improper 409A valuations because your financials are inconsistent? Stock option grants can be challenged.

I've seen founders face six-figure penalties because they didn't realize their financial chaos had created compliance violations. The IRS doesn't care that you were "too busy building product" to get the books right.

The Compounding Effect: Chaos Breeds More Chaos

Here's what makes financial chaos so dangerous: it compounds.

You skip reconciliation one month because you're too busy. Then two months. Then six. Now you're so far behind that catching up feels impossible. So you don't. The gap widens.

You mis-categorize expenses because you're rushing. Now your reports are wrong. You make decisions based on wrong reports. Those decisions make things worse. Which creates more chaos. Which makes you avoid looking at the numbers. Which delays fixing them. Which makes everything worse.

It's not a linear problem. It's exponential.

One founder I coached didn't reconcile his accounts for nine months. When we finally sat down to clean it up, we discovered he'd been double-counting revenue from a payment processor. His actual revenue was 30% lower than he thought. He'd made hiring decisions, marketing investments, and strategic commitments based on revenue that didn't exist. Unwinding those decisions cost him 18 months of progress.

What Financial Chaos Really Costs At Each Stage

The damage scales with your business.

Pre-Seed: The Foundation Crack

At pre-seed, financial chaos costs you credibility with early investors and advisors. You can get away with imperfection, but you can't get away with negligence. Investors at this stage are betting on you more than your metrics—but if you can't show basic financial discipline, they question everything else.

Cost: Failed angel rounds, loss of advisor trust, personal financial stress.

Seed: The Scaling Illusion

At seed stage, financial chaos hides your real unit economics. You think you have product-market fit because revenue is growing. But you don't know if you're making or losing money on each customer. You scale what should be fixed, then hit a wall at $1M ARR when the economics break.

Cost: Misallocated growth capital, delayed Series A timeline, potential down rounds.

Series A: The Trust Collapse

At Series A, financial chaos kills deals. Period. Investors at this stage expect financial maturity. They expect clean books, reliable metrics, and forward visibility. When you can't deliver, they don't just pass—they question if you're ready to scale at all.

Cost: Failed raises, burned bridges with top-tier VCs, forced alternative financing at worse terms.

The Opportunity Cost Nobody Talks About

Here's the cost that hurts the most: what you could have built instead.

Every hour you spend fixing financial chaos is an hour you're not spending on:

Building relationships with strategic customers

Refining your product roadmap

Developing your team

Thinking about competitive positioning

Iterating on go-to-market strategy

Financial chaos doesn't just cost money. It costs focus. It costs momentum. It costs the compounding value of spending your limited founder energy on things that actually move the business forward.

I've mentored founders who spend 40% of their time on financial operations that should be automated. That's two full days a week. Multiply that over a year, over three years. That's the difference between a company that hits inflection and one that doesn't.

The Breaking Point: When Chaos Becomes Crisis

Most founders don't fix their financial chaos until it reaches crisis.

The crisis is usually one of three things:

An investor asks for financials you don't have

You run out of cash and realize too late

An audit or compliance review exposes the mess

By then, the damage is done. You're not fixing chaos—you're doing emergency triage. And emergency triage is expensive, stressful, and often too late.

One founder I worked with only fixed his books when his acquirer demanded clean financials as a condition of closing. The cleanup took six weeks. The deal almost died twice. He lost $500K in valuation because the chaos created negotiating leverage for the buyer. All because he didn't fix it when it was manageable.

The Actual Cost: A Breakdown

Let's put numbers to it. For an average early-stage startup with $1M-$3M in revenue:

Direct costs:

Time spent on financial operations: $100K/year

Cleanup and accounting fees: $20K-$50K

Software and integration costs: $30K/year

Indirect costs:

Delayed or failed fundraising: $500K-$5M+ (in valuation or inability to raise)

Wrong strategic decisions: $100K-$500K (in misallocated resources)

Lost employees due to equity confusion: $150K-$300K (in recruiting and productivity loss)

Compliance penalties and legal fees: $10K-$100K+

Total annual cost: $910K-$6.08M+

That's not a typo. Bad books can cost you millions. Not over ten years. In one fundraising cycle.

Why Founders Stay Stuck In The Chaos

If the costs are this high, why doesn't everyone fix it?

Because fixing it feels overwhelming. You're already underwater. Adding "fix all the financial systems" to your list feels impossible. So you don't. You keep patching. You keep delaying. You keep telling yourself you'll deal with it next quarter.

But next quarter never comes. And the chaos gets worse.

The other reason? Most founders don't realize the full cost. They see the time they're spending. They don't see the decisions they're getting wrong. They don't see the investor trust they're losing. They don't see the opportunities they're missing.

Financial chaos is like technical debt. It accrues silently until it collapses the whole system.

The Path Out: What It Actually Takes

Fixing financial chaos isn't about heroic effort. It's about system replacement.

You don't fix chaos by working harder in broken systems. You fix it by choosing better systems that do the work for you.

Stop trying to hold six disconnected tools together with duct tape and manual processes. Stop spending ten hours a week reconciling data that should reconcile automatically. Stop making strategic decisions based on intuition because your data isn't reliable.

The founders who scale aren't smarter. They're just not drowning in financial chaos. They chose clarity early. They invested in systems that give them real-time visibility, automated categorization, and financial intelligence that informs every decision.

They're not spending 40% of their time on bookkeeping. They're spending 40% of their time on growth.

Financial Clarity Is A Competitive Advantage

Here's the truth most founders miss: good financials aren't just about compliance or fundraising. They're a weapon.

When you have real-time visibility into your metrics, you see opportunities competitors miss.

When you can model scenarios in minutes instead of days, you move faster.

When you speak to investors with financial fluency, you command the room.

The best founders I've worked with don't just have clean books. They have financial systems that give them unfair advantages. They know their unit economics by cohort. They see burn trends before they become problems. They model hiring scenarios in real-time.

That's not just organization. That's competitive intelligence.

The Real Question

The question isn't whether financial chaos is costing you. It is.

The question is: how much are you willing to lose before you fix it?

Every month you delay is another month of decisions made in the dark. Another month of investor trust eroding. Another month of opportunities missed.

You can't out-execute bad information. You can't out-hustle broken systems. At some point, the chaos catches you. And when it does, it's expensive.

Fix it now, when it's manageable. Not later, when it's crisis.

For a step-by-step guide to setting up clean books at every funding stage, see our complete guide to bookkeeping for startups.

Futureproof was built to replace financial chaos with clarity. We automate bookkeeping, calculate the metrics that matter, and give you real-time visibility into your business without the ten-tool nightmare. If you're tired of drowning in spreadsheets and disconnected systems, book a demo and see what financial clarity actually looks like.